Unusual Options Activity in Cameco Corporation (CCJ) and Ebix, Inc. (EBIX), and the Amazon (AMZN) Stock Split Announcement

Unusual Options Activity in Cameco Corporation (CCJ)

Today, March 10, 2022, in the NYSE, there was unusual or noteworthy options trading activity in Cameco Corporation (CCJ), which opened at $27.04.

- There were 7,500 contracts cross traded on the $40 strike call options for June 17th, 2022 traded at a spot price of $0.87 with a bid-ask spread of $0.82 to $0.95.

- The open interest on this chain was 693 as of this morning’s open.

- Additionally, these orders come after the Motley Fool reported that Cameco “is up another 17% already so far in March, which means anyone who'd bought Uranium Energy shares at closing on Jan. 31 is sitting on almost 80% gains as of this writing.”

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

- As can be seen, these cross trades were a series of orders of varying sizes, from 4,800 to 7,500 contracts traded.

- Overall, there was an aggregated trade of 6,000 contracts on the $30 strike call option for the June 17th expiration which now has 6,302 volume.

As stated, the orders in this report were cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

To view more information about CCJ's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Ebix, Inc. (EBIX)

In the NasdaqGS, there was unusual or noteworthy options trading activity in Ebix, Inc. (EBIX), which opened today at $34.00.

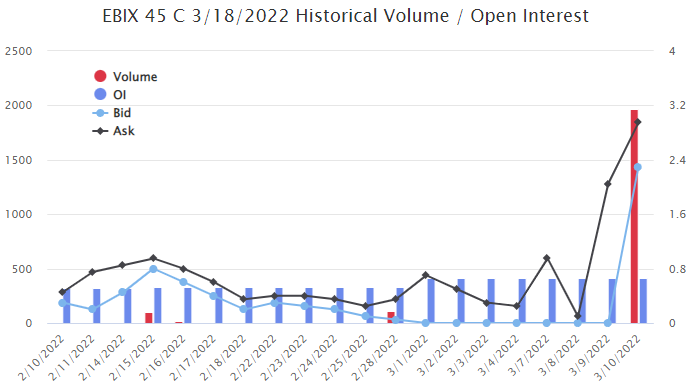

- There were a series of repeated orders on the $45 strike call option dated for March 18th, 2022 traded at the ask of $3.20 with a bid-ask spread of $2.90 to $3.20.

- These orders come after Ebix today announced that its Indian subsidiary EbixCash Limited filed a Draft Red Herring Prospectus (DRHP).

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

A tip from the flow: The ! emoji means the volume of the chain is greater than the open interest on the chain itself.

There has been a maintained 412 open interest on this chain for some time, but the volume of 1,975 contracts traded are novel, implying that they were to open, not to close. Be mindful: contracts can be bought or sold to open, so this is not an indication of direction, merely that the contracts are open on the market, not closed.

To view more information about EBIX's flow breakdown, click here to visit unusualwhales.com.

Have you read the Unusual Whales Stock Splits Deep Dive yet?

In this report, we took a look at Google (GOOGL), Tesla (TSLA), Amazon (AMZN) and many others to see if there is any change in trading surrounding split announcements and split dates themselves.

We uncovered:

- Stocks increased an average +4.95% between the date the split was announced and the actual split date

- Megacaps are hot for splits

- On average, following the split announcement date, stocks returned ~+3% within 5 days

- Best time-money return was observed within 5 days for both split dates and announcement dates

Options Order Flow Activity Surrounding the Amazon (AMZN) Stock Split

After market close on March 9th, 2022, Amazon, despite past protests from its founder Jeff Bezos, announced a 20:1 stock split.

Immediately following the announcement, AMZN shares jumped 10% in the after hours, after settling in at a 7% gain on the announcement.

So, how did the flow look the past week?

From a date range of February 28th until the day of the split, March 9th, AMZN flows were ask side primarily, with bullish volume, but primarily bearish leaning due to news driven events in recent weeks. Given this information, it doesn't seem like the general public--or even insiders--knew about AMZN's split.

However, there was a few large sized weekly DITM trades placed this morning, with two of them being over 8 million in premium.

Go read the full report here for a deep dive into stock splits!

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.