Unusual Options Activity in Camping World Holdings, Inc. (CWH), Meta Platforms, Inc. (FB), and Futu Holdings Limited (FUTU)

Unusual Options Activity in Camping World Holdings, Inc. (CWH)

Today, March 21, 2022, in the NYSE, there was unusual or noteworthy options trading activity in Camping World Holdings, Inc. (CWH), which opened at $31.12.

- There were a series of orders including sweeps on the $33 strike call option dated for April 1st, 2022, traded at the ask of $0.50 with a bid-ask spread of $0.25 to $0.50.

- The open interest on this chain was 172 contracts open and the overall volume is now approximately 3,197, implying these trades were being opened, not closed.

A tip from the flow: The ⚠️emoji means the size of the order was greater than the open interest on the chain itself.

Additionally, these orders come after Zacks reported that:

The company is expected to report EPS of $1.39, down 0.71% from the prior-year quarter. Meanwhile, the Zacks Consensus Estimate for revenue is projecting net sales of $1.65 billion, up 5.97% from the year-ago period.

Furthermore, these orders were also spotted on the NEW Unusual Whales hottest chains tool. As seen, the contracts had an acceleration factor of 0.72, implying there was a rapid increase in trading activity over open interest on this chain. Additionally, of the OHLC charts seen above, it is seen that the opening price on the chain is lower than its high, which is about the last price, or what it is currently trading at.

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

The volume on this chain has now increased in excess over the open interest, so some of these contracts must have been bought or sold to open, not to close.

To view more information about CWH's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Meta Platforms, Inc. (FB)

In the NasdaqGS, there was unusual or noteworthy options trading activity in Meta Platforms, Inc. (FB), which opened today at $214.50.

- There were 6,951 contracts traded on the $212.5 and $215 strike call options dated for March 25th, 2022.

- The $212.5 strike chain had an open interest of approximately 9K and now has a volume of approximately 10K.

- The $215 strike chain had an open interest of approximately 5K and now has a volume of approximately 14K.

- Therefore, it may be intuited that these orders are being either bought or sold to open, not to close, and both of these trades were at the ask.

Additionally, these orders come after the Motley Fool asked: “Where Will Meta Platforms Be in 3 Years?”

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

These orders continued to trickle in at varying sizes, from a single contract to 88 or more and all of them were above the ask of $2.60 at the time of order entry.

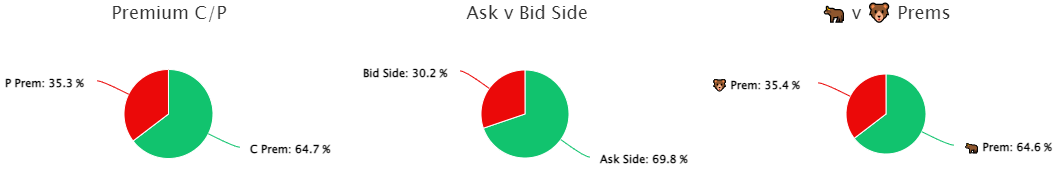

64.6% of the premium traded at these premium levels are in bullish bets, with 69.8% as ask-side orders, and 64.7% are in call premiums.

To view more information about FB's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Futu Holdings Limited (FUTU)

Finally in the NasdaqGM, there was unusual or noteworthy options trading activity in Futu Holdings Limited (FUTU), which opened today at $38.05.

- There was repeated trading activity on the $70 strike call options dated for January 20th, 2023.

- Additionally, these orders come after the Motley Fool explained why shares of the Hong Kong-based online wealth management and brokerage company Futu Holdings traded 36% higher last week.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

As seen, the open interest on this chain is 950, but the volume on the day is only just 228, so therefore it cannot be known as to whether these contracts were bought or sold to open.

To view more information about FUTU's flow breakdown, click here to visit unusualwhales.com.