Unusual Options Activity in Canopy Growth Corporation (CGC), BlackBerry Limited (BB), and Sunnova Energy International Inc. (NOVA)

Unusual Options Activity in Canopy Growth Corporation (CGC)

Today, December 20, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Canopy Growth Corporation, which opened at $9.05.

- There were 28,000 and then another 3,000 contracts traded on the $7.5 strike put option contract, sold to open at the bid, dated for January 21st, 2022.

- These contracts represent approximately 3,100,000 shares and $682,000 in premium traded.

These orders come after Sushree Mohanty from The Motley Fool asked the question of Canopy Growth Corporation:

“Is Canopy Growth going down the same path as Aurora Cannabis?.”

On the 14th, there were 2,432 contracts in circulation and as of today’s open, there were 2,617. The volume seen today at 35,328 is novel volume, and therefore these orders can be considered to have been bought or sold to open, as there were not enough contracts already in circulation to have closed.

To view more information about CGC's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in BlackBerry Limited (BB)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in BlackBerry Limited (BB), which opened today at $8.96.

- There were 3,873 contracts traded on the $8 strike put option dated for December 31st, 2021.

- There were an additional 3,873 contracts traded on the $7.5 strike put option, for the same date.

- Both of these trades were conducted at or near the ask, however the bid-ask spread on both was quite close, $0.27 to $0.28 for the $8 strike and $0.15 to $0.17 for the $7.5 strike; therefore, it is difficult to truly ascertain the direction of this strategy.

These orders come just ahead of Blackberry’s earnings December 21st, 2021, reported after market close.

As seen, there has been little to no unusual activity, outside of earnings reports, since June 3rd of this year, when $BB had over a million calls traded. Regardless of that, $BB’s average 30 day put volume is 10,700.

To view more information about BB's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Sunnova Energy International Inc. (NOVA)

Again in the NYSE, we saw unusual activity in Sunnova Energy International Inc. (NOVA), which opened at $25.66.

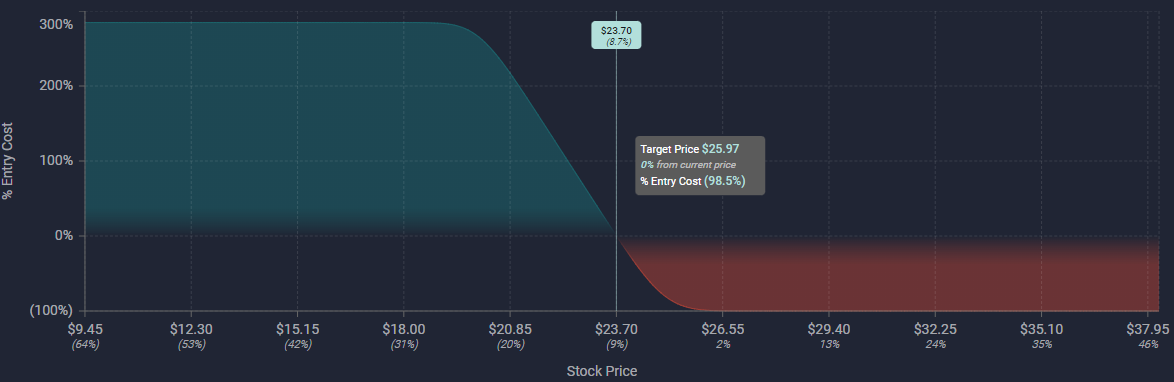

- There were two trades of 2,400 and 3,600 contracts traded, totaling 6,000 contracts on the $25 strike put option, bought to open at the ask, dated for January 21st, 2022.

- Additionally, there were another 6,000 contracts traded on the $20 strike put option, sold to open at the bid, for the same date.

- If these orders were traded together as a part of a strategy, they would represent a bearish put debit spread.

As can be seen, this strategy has a limited upside risk, and limited profit to as $NOVA trends down.

To view more information about NOVA's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.