Unusual Options Activity Captured by Unusual Whales in iShares MSCI Emerging Markets ETF (EEM)

- iShares MSCI Emerging Markets ETF (EEM) experienced significant and unusual options activity during morning trading today

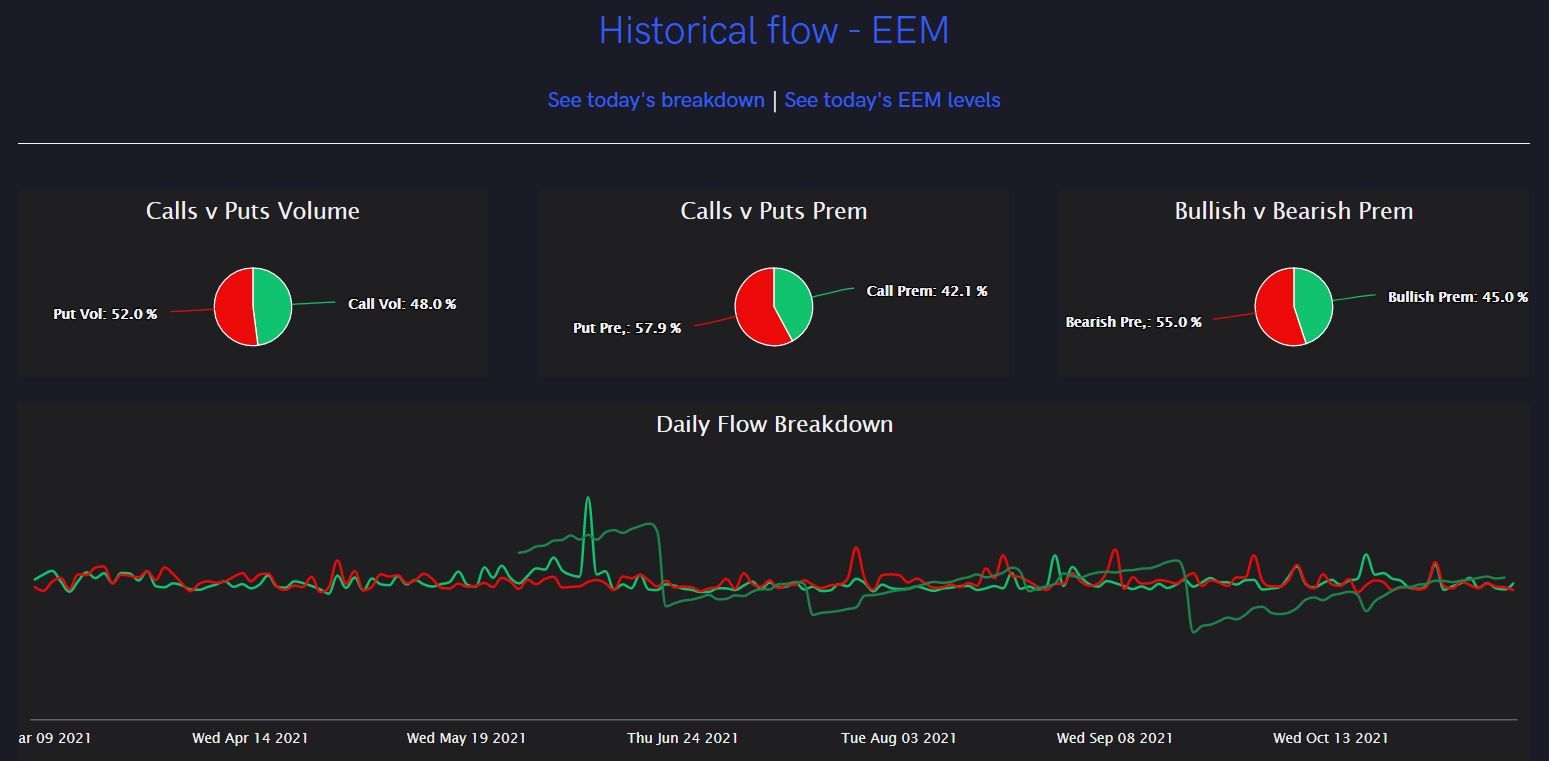

- 90.6% of all premiums spent were flagged by Unusual Whales as bullish

- EEM shares have risen +$0.92 to $51.90, a jump of 1.77%, during the morning session

This morning in the vast sea of tracked Unusual Whales options flow, we observed significant unusual options activity in the iShares MSCI Emerging Markets ETF (EEM). As the name implies, EEM holds and tracks assets in emerging markets, such as Taiwan Semiconductor Manufacturing Co Ltd (TSM) and online commerce company Alibaba (BABA). Starting right at market open, the Unusual Whales Flow Tool captured large options orders.

In one transaction, 3,800 contracts of the $45 put contract expiring June 17th, 2022, were sold at the bid side, for a total premium of $581k. This alone is demonstrative of bullish expectations, as selling puts generally indicates an expectation for the share price to rise (if the share price rises, the seller of those puts is able to pocket the premium they were given to sell those puts).

In addition to these sold puts, the Flow tool captured two massive orders of 18,200 contracts; one on the $54 call strike for January 21, 2022, and another on the $56 call strike of the same date. This is a total of 36,400 contracts for an accumulative premium spent of $1.329 million.

It is also worth noting, two stocks held by EEM made morning moves, as well. At the time of writing, Taiwan Semiconductor Manufacturing Co Ltd (TSM; 6.63% of EEM) is up +$1.84 (1.67%) to $120.07, and Alibaba (BABA; 3.93% of EEM) is up +$4.13 (2.82%) to $167.90.