Unusual Options Activity in CarGurus, Inc. (CARG), Energy Transfer LP (ET), and Beyond Meat, Inc. (BYND)

Unusual Options Activity in CarGurus, Inc. (CARG)

Today, January 03, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in CarGurus, Inc., which opened at $33.72.

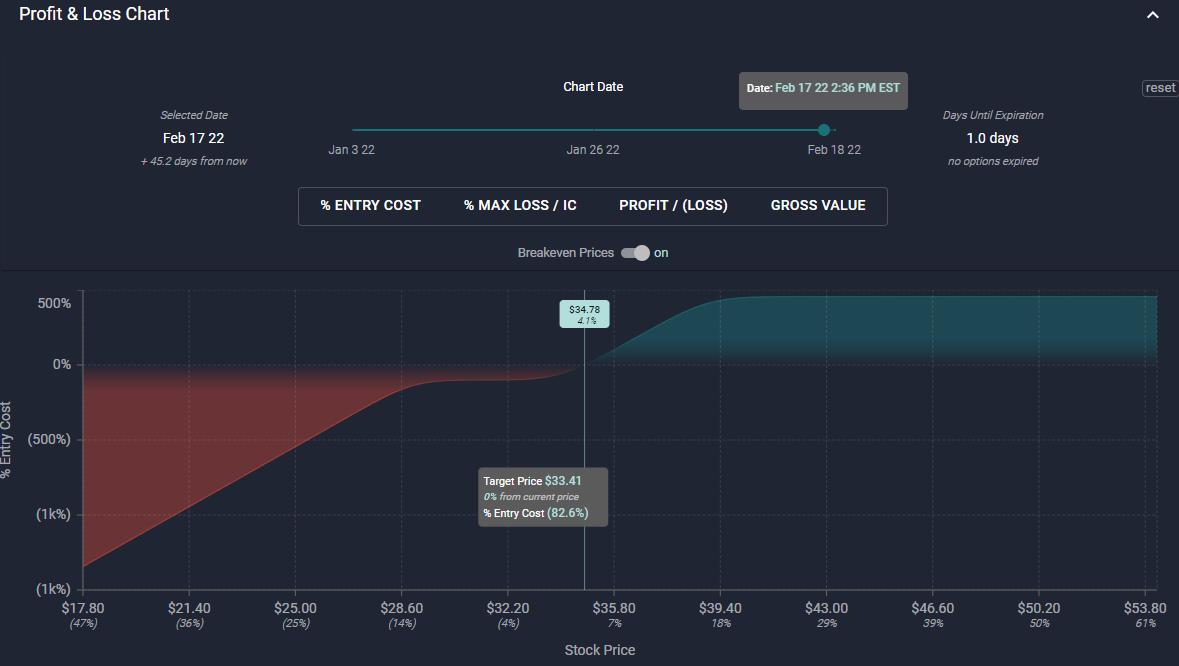

There was a series of orders at 450 contracts apiece, all totaling over 2,000 contracts traded, all dated for February 18th, 2022, on the following three chains:

- The $34 strike call option, traded at $2.3 with a bid-ask of $2.1 - $2.5.

- The $39 strike call option, traded at $0.6 with a bid-ask of $0.25 - $0.95.

- And the $29 strike put option, traded at $0.8 with a bid-ask of $0.45 - $1.15.

These orders come after Simply Wall St inquired: “Will Weakness in CarGurus, Inc.'s Stock Prove Temporary Given Strong Fundamentals?”

Additionally, the put-call ratio on CarGurus, Inc.’s option order flow is at .461, which implies bullishness is increasing.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish.

To view more information about CARG's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Energy Transfer LP (ET)

In the NYSE, we saw unusual or noteworthy options trading volume and activity in Energy Transfer LP (ET), which opened today at $8.27.

- There were 17,000 contracts traded on the $8.5 strike call option dated for January 7th, 2021, bought to open at the ask of $0.18 with a bid-ask of $0.16 - $0.18.

Be mindful! These orders came in as a cross trade. A cross trade occurs when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken, on both the buy and the sell side.

These orders come after reports revealing that Energy Transfer “must pay Williams $410 mln for abandoning $33 bln merger.”

The volume on this chain today overtakes any previous volume; additionally, the bid-ask spread on this chain had reached a historical low on Friday, the 31st.

To view more information about ET's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Beyond Meat, Inc. (BYND)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw reports of unusual or noteworthy options trading volume and activity in Beyond Meat, Inc. (BYND), which opened today at $65.68.

- There were 5,000 contracts sold to close on the $55 strike put option dated for February 18th, 2022.

- There were an additional 5,000 contracts bought to open on the $55 strike put option dated for March 18th, 2022.

These orders come after Joey Frenette of TipRanks asked: “Can Beyond Meat Stock Turn Around in 2022?”

As of today’s open, the open interest on the chain was 54. The volume of 5,030 today was therefore the opening volume, as there were no contracts to close.

Therefore, it is evident that this trader was rolling their contracts from the February expiration to March.

To view more information about BYND's flow breakdown, click here to visit unusualwhales.com.