Unusual Options Activity in Catalent, Inc. (CTLT), Citigroup Inc. (C), and Alcoa Corporation (AA)

Unusual Options Activity in Catalent, Inc. (CTLT)

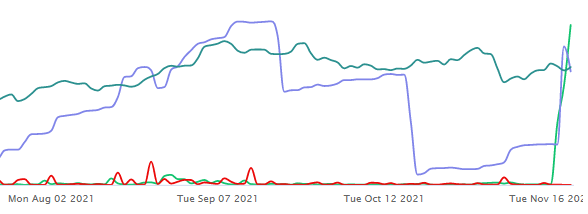

Today, November 19, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Catalent, Inc., which opened at $130.84.

There were 5,000 contracts traded on the $130 strike call option, bought to open at the ask, dated for December 17th, 2021.

Additionally, there were 5,000 and 3,000 contracts in two orders, totalling 8,000 contracts, traded on the $135 and $140 strike call options, sold at the bid, and for the same date. It is presumed the $140 strike call options were sold to open, but the $135 strike call options had a higher open interest than volume, so that is unclear.

These contracts altogether represent a call debit spread, approximately 1,026,600 shares and $1,846,000 in premium traded.

These orders come after Simply Wall St established that:

As of this writing, Catalent, Inc. has had 13,040 calls traded, which is roughly over 4,000% greater than its 30-day call average.

To view more information about CTLT's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Citigroup Inc. (C)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Citigroup Inc. (C), which opened today at $66.12.

There were 14,538 contracts traded on the $60 strike put option, dated for December 17th, 2021, bought at the ask.

These contracts represent approximately 1,453,800 shares and $582,000 in premium traded.

These orders came after BNK Invest reported that Citigroup Inc.:

Thursday, shares of Citigroup Inc's 7.125% Fixed Rate/Floating Rate Noncumulative Preferred Stock, Series J (Symbol: C.PRJ) were yielding above the 6.5% mark based on its quarterly dividend (annualized to $1.7812), with shares changing hands as low as $27.40 on the day.

62.5% of the premium traded at these premium levels are in bullish bets, with 71.1% as bid-side orders, and 36.4% are in call premiums.

To view more information about C's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Alcoa Corporation (AA)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity today in Alcoa Corporation (AA), which opened at $47.31.

There were 2,250 contracts traded on the $46 strike put option, bought to open at the ask, dated for December 17th, 2021.

Additionally, there were 1,750 contracts traded on the $48 strike put options, at the bid, and for the same date; these contracts had higher open interest than volume.

These contracts altogether represent a put credit spread, approximately 400,000 shares and $1,174,000 in premium traded.

These orders came after Alcoa Corporation presented at the virtual Goldman Sachs Global Metals & Mining Conference.

52.3% of the premium traded at these premium levels are in bearish bets, with 58.3% as ask-side orders, and 86.6% are in call premiums.

To view more information about AA's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.