Unusual Options Activity in the Cboe Volatility Index (VIX), Qorvo, Inc. (QRVO), and Lucid Group, Inc. (LCID)

Unusual Options Activity in the Cboe Volatility Index (VIX)

Today, December 06, 2021, there were noteworthy contracts traded on the VIX, which opened at $28.99.

- There were 7,300 contracts traded on the $35 strike call option dated for January 19th, 2022 sold to close at the bid; however, this chain’s open interest was higher than its volume, so it cannot be absolutely ascertained whether these contracts were closed or opened, but can be verified looking at tomorrow’s open interest.

- Additionally, there were 36,500 contracts traded on the $70 strike call option dated for June 15th, 2022, bought to open at the ask; this trade’s volume was in fact greater than its open interest, so these contracts were either bought or sold to open.

- N.B., this is the VIX, which is traded throughout the year, even in out of the money positions, for a variety of reasons; speculation on volatility is to be expected, regardless of news.

These orders come after Chris Versace, Lenore Elle Hawkins, and Mark Abssy asked the question in their “Daily Markets” post:

“Will Evergrande and China Set Tone for the Week?”

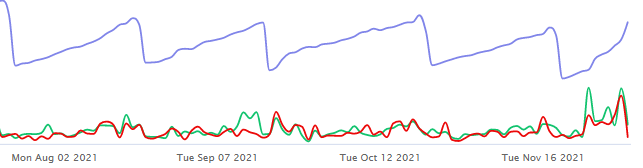

As seen, the VIX regularly ebbs and flows calculated from its requisite futures pricing; however, recently, more options contracts have been traded on it, outside of its typical mean, seen in the green and red lines.

It will be worth watching the options flow, amongst other indicators, on volatility products going forward to understand the overarching market sentiment.

To view more information about VIX's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Qorvo, Inc. (QRVO)

Within the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Qorvo, Inc. (QRVO), which opened today at $150.65.

There were 118 contracts and then dozens more, amounting to over 201 on the chain, traded on the $170 strike call option, dated for January 20th, 2023, bought to open above the ask.

These orders come after Simply Wall St expressed shareholders might be concerned after seeing the share price drop 22% in the last quarter.

93.1% of the premium traded at these premium levels are in bullish bets, with 92% as ask-side orders, and 97.5% are in call premiums.

To view more information about QRVO's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Lucid Group, Inc. (LCID)

Finally, and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Lucid Group, Inc. (LCID), which opened at $40.03.

There have been a variety of contracts traded on $LCID this morning, such as but not limited to:

- $20 strike puts sold to open dated for May 20th, 2022.

- $75 strike calls sold to close dated for January 20th, 2023, and bought to open for January 19th, 2024.

- The overall flow of $LCID this morning is held up in 53.06% bullish premiums.

These orders come after Dan Caplinger of The Motley Fool reported:

In its filing, Lucid merely said that it had received a subpoena to produce documents related to an SEC investigation.

45% of the premium traded at these premium levels are in bullish bets, with 65% as ask-side orders, and 55.8% are in call premiums.

To view more information about LCID's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.