Unusual Options Activity in Chevron Corporation (CVX), Under Armour, Inc. (UAA), and Marathon Petroleum Corporation (MPC)

Unusual Options Activity in Chevron Corporation (CVX)

Today, January 05, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Chevron, which opened at $122.24.

- There were 3,381 contracts traded on the $122 strike put option dated for January 21st, 2022.

- These orders came in tagged as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

- On the Unusual Whales blog is a report on floor traders' performance. Here is a snippet:

More interestingly, we found that floor traders do not bet on crazy far OTM calls.

Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.

These orders come after Dan Caplinger of The Motley Fool explained how Chevron is one of the “Dogs of the Dow” for 2022.

35.12% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums.

Furthermore, the $5,000 premium levels are in bullish premiums at 39.17%. The majority of betting, therefore, are in bearish strategies.

To view more information about CVX's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Under Armour, Inc. (UAA)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Under Armour, Inc. (UAA), which opened today at $21.33.

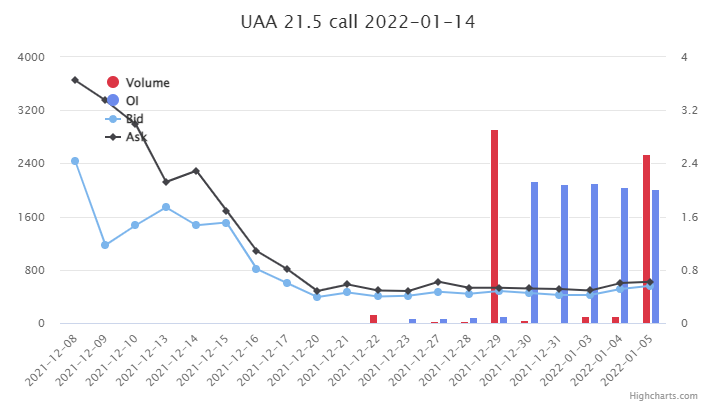

- There were 2,500 contracts traded on the $21.5 strike call option dated for January 14th, 2021.

- This chain had an open interest of approximately 2,000 this morning, and as these orders were sized greater than that, at 2,500, it can be intuited these contracts were in fact bought to open.

A tip from the flow: Trades appended with 🛍️ can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the 🛍️ symbol).

Be mindful! Trades without the 🛍️ symbol might still have been bought or sold to open!

These orders come after Simply Wall St reported:

“Under Armour's TSR for the year was broadly in line with the market average, at 24%. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 5% over the last five years.”

The open interest on these contracts has not changed since that initial volume spike on the 29th of December. As the volume today was higher than the open interest, it can be intuited that these contracts were potentially bought to open.

However, throughout the day, traders may be looking to exit on this chain, as well, or exercise the contracts (for any reason), so only by looking back at the open interest tomorrow can we know as a matter of fact.

To view more information about UAA's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Marathon Petroleum Corporation (MPC)

Finally and again, in the NYSE, we saw unusual or noteworthy options trading volume and activity in Marathon Petroleum Corporation (MPC), which opened today at $68.98.

- There were 15,000 contracts traded on the $75 strike call option dated for April 14th, 2022, bought to open at the ask.

- There were an additional 15,000 contracts more than likely sold to close on the $67.5 strike call option dated for January 21st, 2022.

- The open interest on the $67.5 chain was approximately 41,000, and as these orders came in together, it may be intuited that the trader is closing their existing positions on this chain and rolling them out to a later date and higher strike.

These orders come after Reuters reported: “US STOCKS-Futures dip as tech stocks extend fall; Fed minutes eyed”

The January 21st, 2022 $67.5 strike call option is the most traded chain thus far today, with 16,126 volume, albeit with the previously mentioned 40,992 open interest.

What is noteworthy, however, is the April 14th, 2022 $75 strike call contract which now is the second most voluminously traded contract, with 15,270 volume but only 1,212 open interest.

To view more information about MPC's flow breakdown, click here to visit unusualwhales.com.