Unusual Options Activity in Cinemark Holdings, Inc. (CNK), BP p.l.c. (BP), and Uber Technologies, Inc. (UBER)

Unusual Options Activity in Cinemark Holdings, Inc. (CNK)

Today, March 23, 2022, in the NYSE, there was unusual or noteworthy options trading activity in Cinemark Holdings, Inc. (CNK), which opened at $16.74.

- There were a series of orders including sweeps on the $20 strike call option dated for April 14th, 2022, traded at the ask of $0.15 with a bid-ask spread of $0.05 to $0.15.

- The open interest on this chain was 588 contracts open and the overall volume is now 4,397.

- Of note, the largest sized order was 2,110 contracts, and then the sweeps thereafter ranging from 150 to 781 contracts traded, picture here:

Tips from the flow!

Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

(Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).)

The ⚠️emoji means the size of the order was greater than the open interest on the chain itself.

The ! emoji means the volume of the chain is greater than the open interest on the chain itself.

Furthermore, these orders were also spotted on the NEW Unusual Whales hottest chains tool. As seen, the contracts had an acceleration factor of 0.93, implying there was a rapid increase in trading activity over open interest on this chain.

As stated, some of these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

The volume on this chain has now increased in excess over the open interest, so these contracts must have been bought or sold to open, not to close.

To view more information about CNK's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in BP p.l.c. (BP)

In the NYSE, there was unusual or noteworthy options trading activity in BP p.l.c. (BP), which opened today at $30.50.

- There were a series of orders on the $41 strike call option dated for October 21st, 2022, bought to open at the ask of $0.45 with a bid-ask spread of $0.42 to $0.45.

Additionally, these orders come after Reuters reported that “BP seeks to sell shut-down North Sea oilfield, riding wave of demand -sources”.

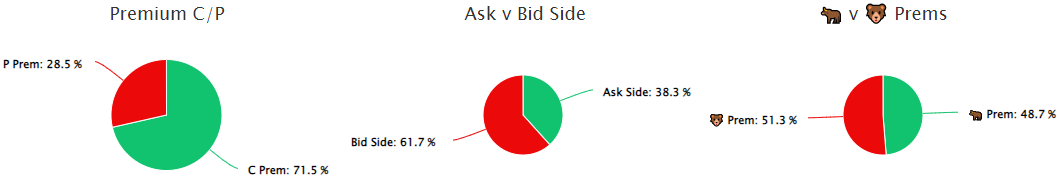

48.7% of the premium traded at these premium levels are in bullish bets, with 38.3% as ask-side orders, and 71.5% are in call premiums.

To view more information about BP's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Uber Technologies, Inc. (UBER)

Finally in the NYSE, there was unusual or noteworthy options trading activity in Uber Technologies, Inc. (UBER), which opened today at $32.71.

- There was repeated trading activity on the $40 strike call options dated for May 20th, 2022, bought to open above the ask at $0.80 with a bid-ask spread of $0.75 to $0.80.

- Additionally, these orders come after Reuters reported: “Uber aims to service Mexico City's distant new airport in 'near future”.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

Please note, the open interest on this chain is approximately 35K today, so therefore even though these orders are above the ask, it cannot be adequately known whether these orders are being bought to open or to close, which can only be determined by looking at the open interest tomorrow.

To view more information about UBER's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.