Unusual Options Activity in Confluent, Inc. (CFLT), Moderna, Inc. (MRNA), and Pinterest, Inc. (PINS)

Unusual Options Activity in Confluent, Inc. (CFLT)

Today, November 29, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Confluent, Inc., which opened at $82.00.

There were two sets of orders, one sized at 10,044 contracts and another at 2,512 contracts traded for the $65 strike put option dated for December 17th, 2021, sold to open at the bid. The open interest on these chains this morning was 454.

These orders come after Confluent, Inc. reported its Q3 earnings.

As of this writing, Confluent, Inc. has had 13,000 puts traded, which is 1,083% greater than its 30-day put average.

To view more information about CFLT's daily flow breakdown, click here to visit unusualwhales.com.

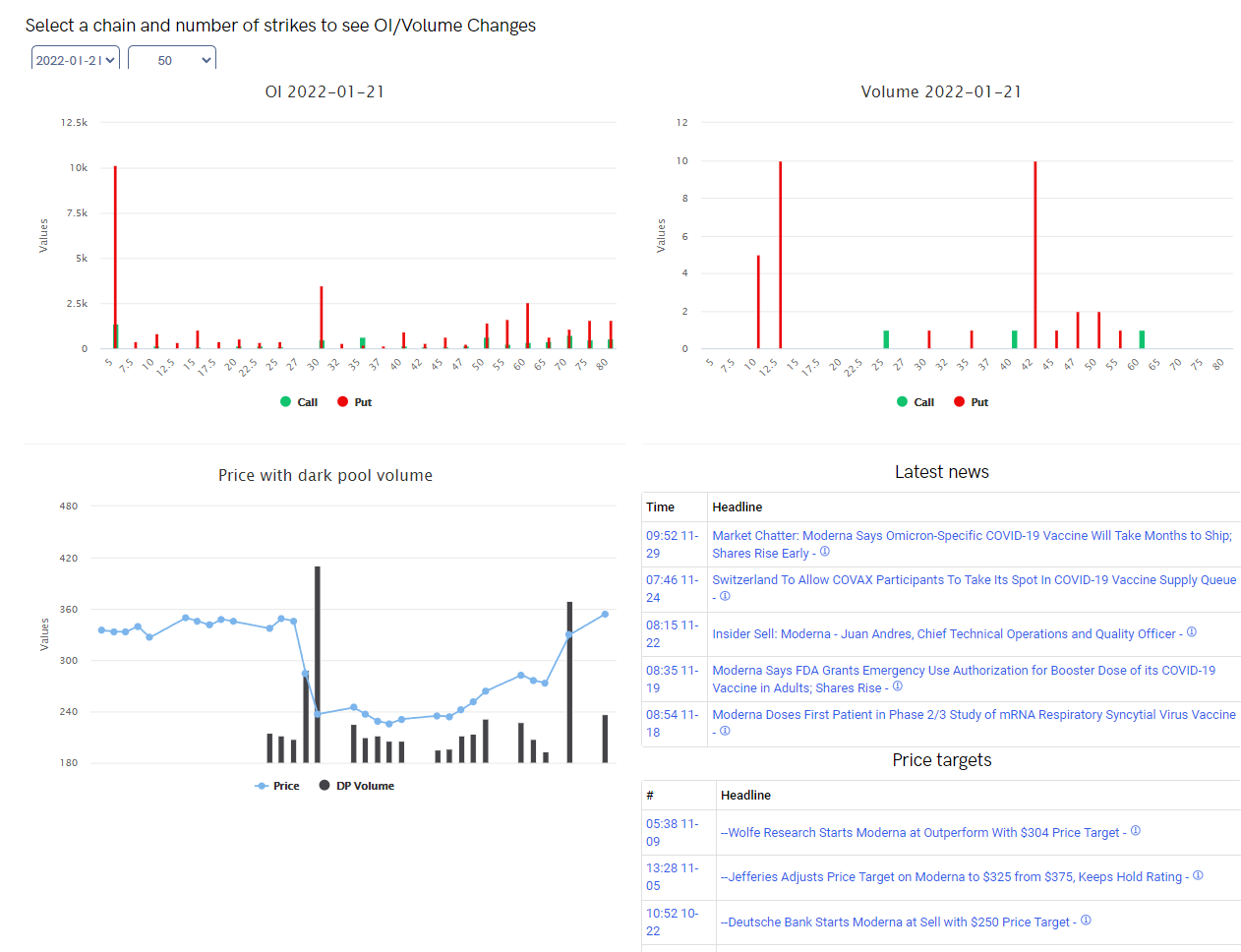

Unusual Options Activity in Moderna, Inc. (MRNA)

Again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in Moderna, Inc. (MRNA), which opened today at $370.33.

There were 1,900 contracts traded on the $230 strike put option, above the ask, dated for January 21st, 2022.

These orders come after Manas Mishra from Reuters reported that Moderna, Inc. could take months to begin shipping a COVID-19 vaccine that works specifically against the Omicron variant, its chief executive officer, Stéphane Bancel, told CNBC on Monday.

59.3% of the premium traded at these premium levels are in bullish bets, with 67.9% as ask-side orders, and 86.1% are in call premiums.

To view more information about MRNA's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Pinterest, Inc. (PINS)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Pinterest, Inc. (PINS), which opened at $42.87.

There were 2,500 contracts traded on the $55 strike call option, again above the ask, dated for February 18th, 2022.

These orders come after Rick Munarriz from The Motley Fool reported:

“The good news is that Pinterest has learned to milk more ad revenue from its users. Revenue has soared 43% over the past year with net income; adjusted earnings; and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) all more than doubling. In short, the financials are improving even as investors have been bailing on the stock. The shares have fallen 53% since peaking in February.”

94.1% of the premium traded at these premium levels are in bullish bets, with 88.6% as ask-side orders, and 94.4% are in call premiums.

To view more information about PINS's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.