Unusual Options Activity in Constellation Brands, Inc. (STZ), Vodafone Group Public Limited Company (VOD), and Block, Inc. (SQ)

Unusual Options Activity in Constellation Brands, Inc. (STZ)

Today, February 18, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Constellation, which opened at $218.02.

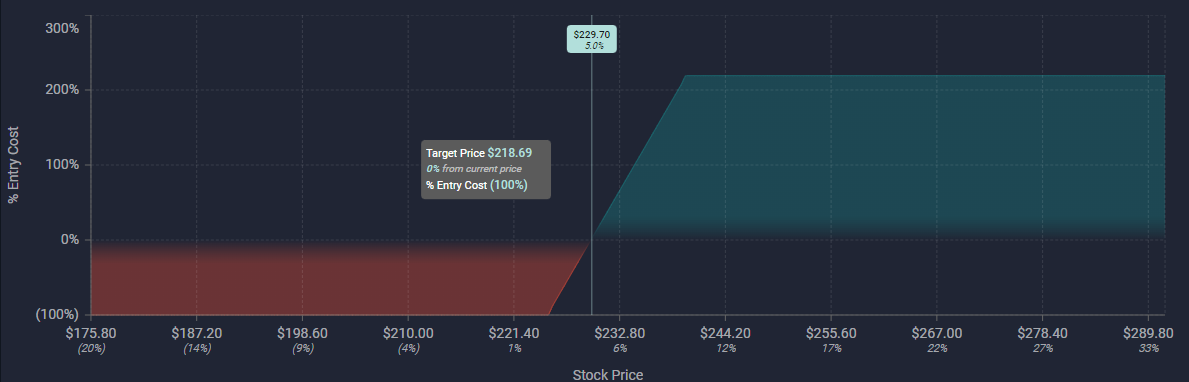

- There were 1,000 contracts traded on the $225 strike and $240 strike call options dated for April 14th, 2022, appearing to have come in as a call debit spread, in which the $225s were brought to open and the $240s were sold to open.

- Both of these chains’ open interests were less than the sizes of these orders, implying that they were in fact to open, and the sides taken is assumed from the spot prices relative to the bid-ask spreads, seen below.

Additionally, these orders come after Constellation “crossed below their 200 day moving average of $228.38, changing hands as low as $227.05 per share”.

A tip from the flow: Trades appended with the ↕ emoji are trades that have potentially came in together as a part of a strategy, and are coded accordingly as MLET or MLFT, under the codes column. Click on that emoji will open all of the trades that came in together so that the holistic strategy may be investigated.

The visualization is situated on the expiration date of April 14th, 2022, and this strategy has a maximum loss of approximately $470, or the debit paid at entry, with a maximum upside of $1,000 which occurs if Constellation reaches $240 or higher.

To view more information about STZ's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Vodafone Group Public Limited Company (VOD)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual activity in Vodafone Group Public Limited Company (VOD), which opened today at $18.73.

There were 2,919 contracts each traded on the April 14th, 2022 expiration on the following chains:

- $19 strike call options at a spot of $0.74 with a bid-ask spread of $0.66 to $0.76.

- $18 strike put options at a spot of $0.54 with a bid-ask spread of $0.48 to $0.55.

- $19 strike put options at a spot of $1.60 with a bid-ask spread of $1.58 to $1.66.

- These orders may be interpreted as a bullish put credit spread and an out of the money long call.

Additionally, these orders come after Vodafone “rejected a preliminary approach from French telecom group Iliad and private equity firm Apax Partners to buy its Italian business, saying that it was ‘not in the best interests of shareholders’”.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest. Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

81.3% of the premium traded is in bullish bets, with 25.7% of the premium traded is in calls, with 44.4% as ask-side orders. The put call ratio for Constellation is 1.71, which is bearish.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about VOD's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Block, Inc. (SQ)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Block, Inc. (SQ), which opened today at $103.61.

- There were a series of orders swept-to-fill on the $104 strike put option dated for February 25th, 2022, all bought at a spot price of $11 which was above the ask. The bid-ask spread on this chain was $10.75 to $10.95 at the time of the sweep, and now it has edged higher still even to $12.11 as of the time of this writing.

Please be mindful, Block reports its earnings February 24th, 2022, after market close.

Additionally, these orders were found in the new Unusual Whales flow alerts tool, which can point out unusual flow such as but not limited to above-ask orders, such as the ones reported here.

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

- These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

- Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

To view more information about SQ's flow breakdown, click here to visit unusualwhales.com.

Markets Closed Monday, February 21st, 2022

Have a relaxing 3-day weekend! We shall see you Tuesday!

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.