Unusual Options Activity in Coty Inc. (COTY), Opendoor Technologies Inc. (OPEN), and Best Buy Co., Inc. (BBY)

Unusual Options Activity in Coty Inc. (COTY)

Today, November 04, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Coty Inc., which opened at $9.14.

There were 5,940 contracts traded on the $9.5 strike call option, bought to open at the ask, dated for November 19th, 2021.

Additionally, there were another 5,940 contracts on the $9 strike call option, traded at the bid, for the same date.

Of note, the $9 strike contracts has over 32,400 open interest as of this morning’s open, so therefore it cannot be ascertained whether these calls were bought or sold, but the $9.5 strikes were novel volume and that chain’s open interest is 661.

Altogether, these contracts represent approximately 1,188,000 shares and $409,500 in premium traded.

These orders come before Coty Inc. reports its earnings on November 8th, 2021, before market open.

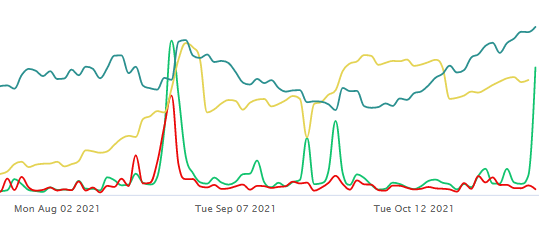

As seen, bearish premium accounts for 63.7% of the options chains, with 66.4% of bid-side orders and 93.9% being in calls.

To view more information about COTY's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Opendoor Technologies Inc. (OPEN)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Opendoor Technologies Inc. (OPEN), which opened at $21.46.

There were a total of 10,000 contracts traded on the $25 strike call option, bought to open at the ask, dated for November 12th, 2021.

Additionally, there were another 10,000 contracts traded on the $35 strike call option, bought to open at the ask, dated for November 19th, 2021.

These contracts represent approximately 2,000,000 shares, and $3,030,000 in premium traded.

These orders come in prior to Opendoor Technologies Inc. reports its earnings on November 10th, 2021, after the market closes.

As seen, bullish premium accounts for 71.8% of the options chains, with 71.1% of ask-side orders and 96.1% being in calls.

To view more information about OPEN's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Best Buy Co., Inc. (BBY)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Best Buy Co., Inc. (BBY), which opened at $126.00.

There were four sets of 10,000 contracts traded on the December 17th, 2021 chains:

- The $130 strike call options were bought to open above the ask.

- The $140 strike call options were sold to open below the bid.

- Then the $125 and $115 strike call options were traded above the ask and at the bid, respectively, however the open interests on these chains were higher than the volumes of these two orders.

Altogether, these trades represent approximately 4,000,000 contracts and $28,400,000 in premium traded.

These orders come after BNK Invest’s reports revealing that Best Buy Co., Inc. has been named a Top Socially Responsible Dividend Stock by Dividend Channel.

As of this writing, BBY has had 64,948 calls traded, which is 855% greater than its 30-day call average.

Curiously, Best Buy Co., Inc.’s ticker is BBY, which resembles BBBY, Bed Bath & Beyond Inc.’s ticker; we recently did analysis on similar tickers and correlations therein--click here to give it a read.

To view more information about BBY's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.