Unusual Options Activity in Coupang, Inc. (CPNG), Citigroup Inc. (C), and Turtle Beach Corporation (HEAR)

Unusual Options Activity in Coupang, Inc. (CPNG)

Today, March 16, 2022, in the NYSE, there was unusual or noteworthy options trading activity in Coupang, Inc. (CPNG), which opened at $16.00.

- There were 7,374 contracts traded on the $17 strike call option contract for March 25th, 2022, bought to open at $1.13 with a bid-ask spread of $0.92 to $1.16.

- The volume on this chain thus far has been 8,017 contracts traded and the open interest was 259 as of this morning’s open. Therefore, we may intuit these contracts are being either bought or sold to open, not being closed.

- Additionally, these orders come after SoftBank sold $1 billion worth of Coupang CPNG.K shares last week at a price per share 30% below that of a similar sale in September.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest. Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

The open interest on this chain today was 259 contracts and the volume thus far has been 8,017; therefore, these contracts may be intuited as having been to open.

To view more information about CPNG's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Citigroup Inc. (C)

In the NYSE, there was unusual or noteworthy options trading activity in Citigroup Inc. (C), which opened today at $56.01.

- There were 5,000 contracts traded above the ask on the $55 strike put options dated for April 14th, 2022.

- The overall volume on this chain has been approximately 11.2K and the open interest on the chain is 35.7K; therefore, it cannot be known if these contracts were opened or closed, but it is significant or noteworthy that they were traded above the ask:

- The spot price of this order was at $2.60 and the bid-ask range on the chain at the time was $2.35 to $2.39.

- These orders come after Reuters reported that U.S. stock index futures surged on Wednesday, spurred by signs of progress in Ukraine-Russia peace talks, while investors braced for a widely expected Federal Reserve interest rate hike later in the day.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

- Of interest, there were another 5,000 contracts traded on the $70 strike put options dated for March 18th, 2022, again above the ask at $15.04 with a bid-ask spread of $14.40 to $14.55.

- Given the open interests of both of these chains were greater than their requisite volumes, it cannot be known whether these were bought or sold to open or to close; however, intuition may lead us to speculate these contracts were rolled from one date to the next, or that they are a part of a calendar spread.

To view more information about C's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Turtle Beach Corporation (HEAR)

Finally in the NasdaqGM, there was unusual or noteworthy options trading activity in Turtle Beach Corporation (HEAR), which opened today at $18.00.

- There were 1,500 contracts traded as floor trades on the $21 strike call option dated for April 14th, 2022 bought to open at the ask of $1.20 with a bid-ask spread of $0.90 to $1.20.

- The overall volume on this chain has been approximately 1.5K, this order, and the open interest was 38, so therefore we may intuit these contracts were bought or sold to open, not closed.

- Additionally, these orders comafter Reuters reported that Donerail drops plan to buy Turtle Beach, instead seeks to oust board.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance. Here is a snippet:

“More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.”

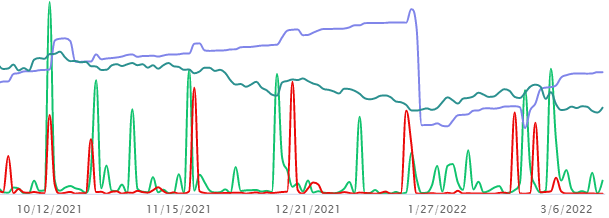

As of this writing, Turtle Beach has had 1,946 calls traded, down from the 18,492 traded on March 1st, 2022, just prior to Donerail’s letter.

To view more information about HEAR's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.