Unusual Options Activity in Curis, Inc. (CRIS), Roblox Corporation (RBLX), and Electronic Arts Inc. (EA)

inferred that

Today, November 10, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Curis, Inc., which opened at $5.72.

- There were 3,000 contracts traded on the $10 strike call option, sold at the bid, dated for December 17th, 2021.

- There were an additional 3,000 contracts traded on the $10 strike call option, bought at the ask, dated for March 18th, 2021.

Altogether, these contracts represent approximately 600,000 shares and $225,000 in premium traded. As the December 17th expiration chain has approximately 3,100 volume and 4,400 open interest, it might be inferred that these puts were rolled out to a later date.

These orders come after Curis, Inc. reported its Q3 earnings.

As seen, bullish premium accounts for 86.7% of the volume at these levels, with 86.7% being ask-side orders, and 100% being in call premium traded.

To view more information about CRIS's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Roblox Corporation (RBLX)

Again in the NYSE, we saw unusual or noteworthy activity in Roblox Corporation (RBLX), which opened today at $103.98.

There were a series of unusual contracts traded on the $92 strike puts, $100 and $110 strike calls, all for relatively shorter dates, such as the November 19th and December 23rd, 2021 expirations.

Altogether, of orders greater than $25,000 and at least 150 contracts ordered, there have been 6,536,897 in calls and 7,443,453 in puts traded, with the most premium-laden expiration being the December 23rd chain with over $97,583,542 in bearish premium traded.

In addition to the above, it is suspected a series of put orders came through, potentially from the same trader or entity:

These orders after Medha Singh and Tiyashi Datta of Reuters reported that “Cathie Wood's ARK Invest has sold some Roblox RBLX.N stock, cashing in on its 42% jump on Tuesday following the gaming company's strong quarterly results”.

As seen, bullish premium accounts for 63.5% of the volume at these levels, with 65.3% being ask-side orders, and 97% being in call premiums traded.

To view more information about RBLX's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Electronic Arts Inc. (EA)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Electronic Arts Inc. (EA), which opened at $139.67.

- There were 2,000 contracts traded on the $143 strike call option, sold at the bid, dated for November 26th, 2021.

- Additionally, there were 2,000 contracts traded on the $145 strike call option, bought at the ask and for the same date.

- Finally, there were another 2,000 contracts traded on the $155 strike calls option, sold at the bid and for the same date.

Altogether these orders approximately 600,000 shares and $1,026,000 in premium traded. The open interest on the $143 strike call contracts was approximately 2,100, which was greater than its volume of 2,000; therefore it cannot be established whether the $143 strike calls were bought or sold to open or to close.

These orders come after Trefis Team’s Trefis reported:

“Going by our Electronic Arts’ Valuation, with an EPS estimate of $6.79 and a P/E multiple of 25x in 2022, this translates into a price of $170, which is 20% above the current market price of around $142.”

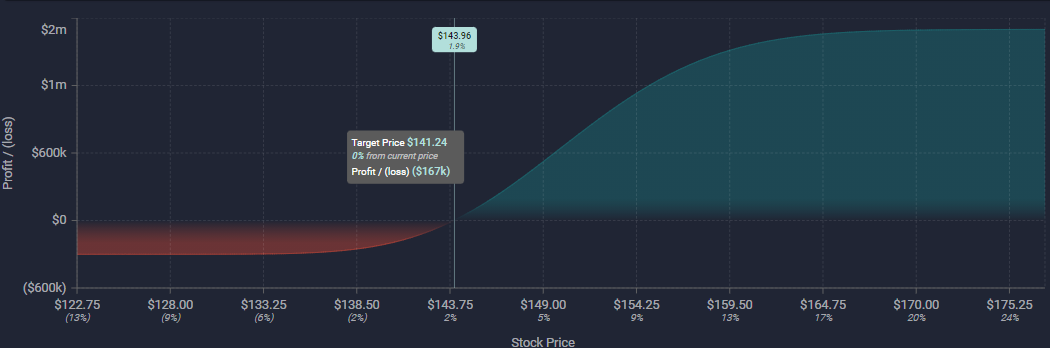

This is a hypothetical trade, in which the calculation above is taken from the November 21st date, with the $143 strike call removed from the strategy, to visualize the $145 and $155 strike call options as a part of a call debit spread, which would be a bullish bet with a limited upside and downside.

To view more information about EA's flow breakdown, click here to visit unusualwhales.com.