Unusual Options Activity in CVS Health Corporation (CVS), Vistra Corp. (VST), and Affirm Holdings, Inc. (AFRM)

Unusual Options Activity in CVS Health Corporation (CVS)

Today, December 21, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in CVS Health Corporation, which opened at $100.79.

- There were 2,000 contracts traded on the $102 strike call option, bought to open at the ask, dated for January 21st, 2022.

- These trades were cross trades. A cross trade occurs when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange.

- In other words, these are an aggregation of many positions taken, on both the buy and the sell side.

These orders come after Kwhen Finance Editors reported:

“The stock is currently up 50.7% year-to-date, up 48.0% over the past 12 months, and up 45.0% over the past five years. This week, the Dow Jones Industrial Average fell 1.7%, and the S&P 500 fell 2.0%..”

Yesterday, on the 20th, there were 0 contracts traded on this chain, as it is a new chain recently added to the montage. Only 85 contracts were traded yesterday, and only 53 of those remained into this morning. The 2,004 traded thus far today are well above that 53 open interest, and therefore were being traded bought or sold to open.

To view more information about CVS's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Vistra Corp. (VST)

Again within the NYSE, we saw unusual or noteworthy options trading volume and activity in Vistra Corp. (VST), which opened today at $21.30.

- There were 10,000 contracts traded on the $23 strike call option, bought to open at the ask, dated for January 21st, 2022.

- Additionally, there were 5,000 contracts traded on the $20 strike call option, sold to close at the bid, for the same date.

- Given the open interest of the $20 strike conutracts was 28,610 and the volume thus far has only been 5,059, it might be posited that these set of contracts were being closed, and this floor trader was rolling their contract up to new strikes, as well as doubling the amount of them, from 5,000 to 10,000.

Be mindful: These trades were marked as “floor” trades. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

On the Unusual Whales blog is a report on floor traders' performance. Here is a snippet:

More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.

As can be seen, the 20,366 volume on the 15th was likely the majority of the entries on this options chain; the trades today corroborate with the 10,000 novel contracts on the $23 strike chain, implying the trader has rolled their position up.

To view more information about VST's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Affirm Holdings, Inc. (AFRM)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Affirm Holdings, Inc. (AFRM), which opened at $21.30.

- There were 2,961 contracts traded on the $110 strike call option, bought to open at the ask, dated for May 20th, 2022. These trades were then cancelled, for any number of reasons, and then were replaced with the exact same number of contracts, strike, and date a few minutes later.

- Please, be mindful: Trades that are struck through have been cancelled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: “for the maintenance of a fair and orderly market.”

- Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

These orders come after Karen Kwok of Reuters reports that “Live now, pay later is fintech’s latest extension”.

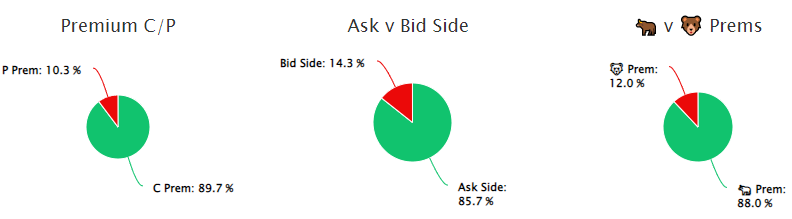

88% of the premium traded at these premium levels are in bullish bets, with 85.7% as ask-side orders, and 89.7% are in call premiums.

To view more information about AFRM's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.