Unusual Options Activity in DXC Technology Company (DXC), Uber Technologies, Inc. (UBER), and Tilray, Inc. (TLRY)

Unusual Options Activity in DXC Technology Company (DXC)

Today, November 09, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in DXC Technology Company, which opened at $33.42.

There were 3,041 contracts traded on the $34 strike put option, sold at the bid, dated for November 19th, 2021.

There were an additional 4,041 contracts traded on the $33 strike put option, bought at the ask, dated for March 18th, 2021.

Altogether, these contracts represent approximately 708,200 shares and $1,780,000 in premium traded.

As the November 19th expiration chain has approximately 3,000 volume and 3,200 open interest, it might be intuited these puts were rolled out to a later date.

These orders come after DXC Technology Company reported its Q3 earnings.

As of this writing, DXC has had 7,089 puts traded, which is 1,298% greater than its 30-day put average.

To view more information about DXC's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Uber Technologies, Inc. (UBER)

Again in the NYSE, we saw unusual or noteworthy activity in Uber Technologies, Inc. (UBER), which opened today at $45.91.

There were a total of 4,227 contracts traded on the $47.5 strike call option, bought to open at the ask, dated for February 18th, 2022.

These contracts represent a put credit spread, approximately 422,700 shares, and $1,400,000 in premium traded.

In addition to the above, it is suspected a series of put orders came through, potentially from the same trader or entity:

These orders after Joey Frenette at TipRanks reported that Uber Technologies, Inc.’s “managers have done an excellent job of navigating out of the gutter this year”.

As seen, bullish premium accounts for 75.9% of the volume at these levels, with 76.8% being ask-side orders, and 98% being in calls.

To view more information about UBER's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Tilray, Inc. (TLRY)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Tilray, Inc. (TLRY), which opened at $12.14.

There were 7,000 contracts traded on the $15 strike call option, bought at the ask, dated for December 17th, 2021.

Additionally, there were another 7,000 contracts traded on the $15 strike puts option, sold at the bid and for the same date.

Altogether these orders represent approximately 1,400,000 shares and $3,048,000 in premium traded.

These orders come after Joe Tenebruso at The Motley Fool reported that there were “reports of a forthcoming Republican-led marijuana legalization bill appeared to drive excitement for pot stocks among investors”.

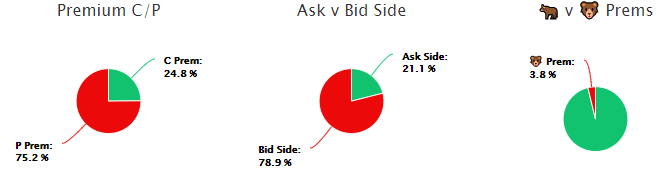

As seen, bullish premium accounts for 96.2% of the volume at these levels, with 78.9% being bid-side orders, 75.2% in put premiums.

To view more information about TLRY's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.