Unusual Options Activity in Elastic N.V. (ESTC), Coupang, Inc. (CPNG), and Palantir Technologies Inc. (PLTR)

Unusual Options Activity in Elastic N.V. (ESTC)

Today, February 09, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Elastic, which opened at $93.09.

The following orders came in together and appear to represent rolling calls expiring in the short-term out to a later date and to higher strikes.

- 1,500 contracts of $90 strike call options dated for February 18th, 2022 sold to close with a relative volume of 2,000 on the chain and an open interest of approximately the same.

- 2,000 contracts each of $100 and $130 strike call options dated for March 18th, 2022 bought to open at the ask, both with higher volumes than their chains’ respective open interests.

You can read more about how to identify rolled contracts on previous posts here, here, and even on Twitter, here.

These orders come after Brett Schafer of The Motley Fool explained “Why Elastic Stock Fell 24.2% in January”.

As noted, the volume from this singular order was 1,500 contracts traded, and now the volume on the chain overall is edging closer to the open interest of approximately 2,400; therefore, we may speculate these orders are in fact being sold to close today and rolled to later expirations and strikes.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

To view more information about ESTC's daily flow breakdown, click here to visit unusualwhales.com.

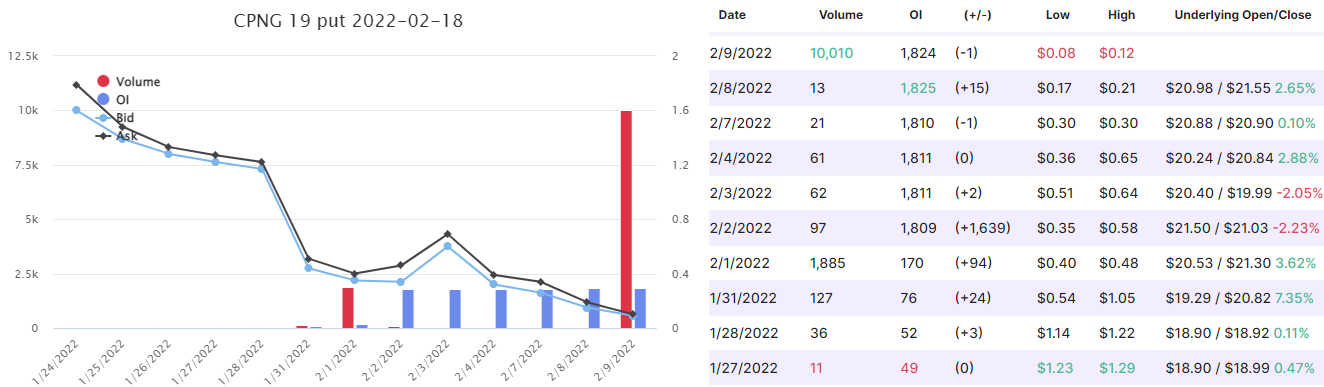

Unusual Options Activity in Coupang, Inc. (CPNG)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Coupang, Inc. (CPNG), which opened today at $21.88.

There were 5,000 contracts traded for each leg of the order and they were all dated for February 18th, 2022:

- $23.5 strike call options sold to open below the bid at $0.32 with a bid-ask range of $0.33 to $0.36; of note, there was 0 open interest on this chain.

- $21 strike put options bought to open at the ask with a bid-ask range of $0.36 to $0.39; there was 107 open interest on this chain.

- $19 strike put options sold to open at the bid with a bid-ask range of $0.09 to $0.11; there was 1,800 contracts open on this chain.

- Overall, these chains now have approximately 10,000 volume traded.

A tip from the flow: Trades appended with the ↕ emoji are trades that have potentially came in together as a part of a strategy, and are coded accordingly as MLET or MLFT, under the codes column. Click on that emoji will open all of the trades that came in together so that the holistic strategy may be investigated.

These orders come after Justin Pope of The Motley Fool reported Coupang is one of the “3 Top E-Commerce Stocks to Buy in February”.

Additionally, on the right, is a table showing the chain’s volume, open interest, change in open interest, the chain’s low and high on its trading price, as well as the underlying stock’s open and close for the day.

It would appear on February 1st a position was taken and maintained into today, with the additional 10,010 new contracts being opened, which we can deduce was also to open.

To view more information about CPNG's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Palantir Technologies Inc. (PLTR)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity inPalantir Technologies Inc. (PLTR), which opened today at $13.29.

- There were 3,136 contracts traded on the $13.5 strike put option at a spot price of $0.90 with a bid-ask range of $0.89 to $0.91; as this bid-ask range is rather tight, and the spot price was at the mid, it cannot in fact be absolutely known whether these contracts were bought or sold to open.

- However, as the size of the trade was greater than the open interest of 2,600 on the chain itself, we can at least know that the orders were in fact to open, not to close.

Additionally, these orders come just ahead of Palantir’s earnings report, upon which Zacks Equity Research reports:

“Palantir Technologies Inc. as it approaches its next earnings report date. This is expected to be February 17, 2022. The company is expected to report EPS of $0.04, down 42.86% from the prior-year quarter. Our most recent consensus estimate is calling for quarterly revenue of $418.1 million, up 29.81% from the year-ago period.”

Only 35.79% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in put premiums. Furthermore, the $5,000 premium levels are in bearish premiums at 56.40%, with greater put premiums than call premiums traded. As can be seen, the overall options order flow on Palantir is bearish.

To view more information about PLTR's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.