Unusual Options Activity in Endo International (ENDP), Visa Inc. (V), and The Kraft Heinz Company (KHC)

Unusual Options Activity in Endo International (ENDP)

Today, December 14, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today inn Endo International, which opened at $4.25.

- There were 2,657 contracts traded on the $5 strike call option dated for December 17th, 2021 (this week’s expiration).

- These orders could have been bought or sold to open, as the bid-ask spread at the time was novel, arguably $0.10 to $0.15, and the resulting spot price was $0.15, therefore while a buy to open can be presumed, that could be misleading.

These orders come after Endo International reported that data from clinical and non-clinical studies of Endo Aesthetics' Qwo® (collagenase clostridium histolyticum-aaes), which received FDA approval in July 2020 for the treatment of moderate to severe cellulite in the buttocks of adult women.

Friday, there was 725 open interest on this chain, and with open today 831 contracts existed. Therefore, the 4,193 volume today could only be considered as being bought or sold to open, as they are entirely new positions taken.

To view more information about ENDP's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Visa Inc. (V)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Visa Inc. (V), which opened today at $210.73.

- There were 10,500 contracts traded on the $220 strike put option, traded at the ask, dated for January 21st, 2022.

- These orders were cross trades, meaning a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken, on both the buy and the sell side.

These orders come just ahead of $V’s earnings report on January 27th, 2022..

68.5% of the premium traded at these premium levels are in bearish bets, with 61.8% as ask-side orders, and 31.1% are in put premiums.

To view more information about V's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in The Kraft Heinz Company (KHC)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in The Kraft Heinz Company (KHC), which opened at $34.38.

- There were 5,000 and 10,000 contracts traded on the $35 strike call option, dated for December 23rd and December 31st, 2021, respectively; these orders came in at the bid.

- Additionally, there were 10,000 contracts traded on the $36 strike call option for the January 14th, 2022 expiration, traded at the ask.

- Of note, the open interest on both the December 23rd and December 31st chains were greater than the volumes of these orders; therefore, it may be intuited that these options contracts were being rolled to one strike above and a further out date.

These orders come after Priti Ramgarhia of TipRanks inked a deal to snap up an 85% stake in Germany-based Just Spices GmbH, while the remaining 15% stake will be retained by Just Spices’ three founders.

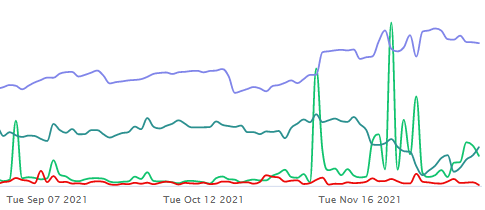

As of this writing, The Kraft Heinz Company has had 6,732 calls traded, which is actually just 95.71% of its 30-day call average. As seen, $KHC has had voluminous options trading recently, most notably with Dr. Michael Burry having sold his stake in the company, reported on November 22nd.

To view more information about KHC's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.