Unusual Options Activity Facebook, Inc. (FB), The Goodyear Tire & Rubber Company (GT), XPeng Inc. (XPEV)

Unusual Options Activity in Facebook, Inc. (FB)

Today, October 25, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Facebook, Inc. , which opened at $320.30.

There were 21,170 contracts traded on the $270 strike put option, at the ask, dated for December 17th, 2021.

These orders represent approximately 2,117,000 contracts and $5,300,000 in premium traded.

These orders come in as Facebook, Inc. is set to report its earnings after market close today..

As seen, bearish premium still accounts for 80.7% of the options chains, with 68.7% in puts and 68.4% as ask-side orders.

To view more information about FB's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in The Goodyear Tire & Rubber Company (GT)

Again, in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in The Goodyear Tire & Rubber Company (GT), which opened at $20.19.

There were 3,300 contracts traded on the $19 strike call option dated for December 17th, 2021.

Altogether, these orders represent approximately 330,000 shares and $693,000 in premium traded.

These orders come in after Simply Wall St’s report on The Goodyear Tire & Rubber Company’s balance sheet:

“Looking at the bigger picture, it seems clear to us that Goodyear Tire & Rubber's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt.”

As of this writing, GT has had 7,241 calls traded, down from October 20th at 9,362 and September 27th at 17,899 calls traded.

To view more information about GT's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in XPeng Inc. (XPEV)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in XPeng Inc. (XPEV), which opened at $44.75.

There were two lots of 3,000 contracts and 2,750 contracts traded on the $55 strike call option, at the ask, dated for November 19th, 2021.

Altogether, these orders represent approximately 5,750 contracts and $558,000 in premium traded.

These orders come after reports from TipRanks’ Mr. Marty Shtrubel revealing:

“Yu’s confidence is conveyed with a new price target which rises from $51 to $57, suggesting room for a 31% uptick over the coming months”.

Furthermore, analysts still hold a buy rating on XPEV as of this writing.

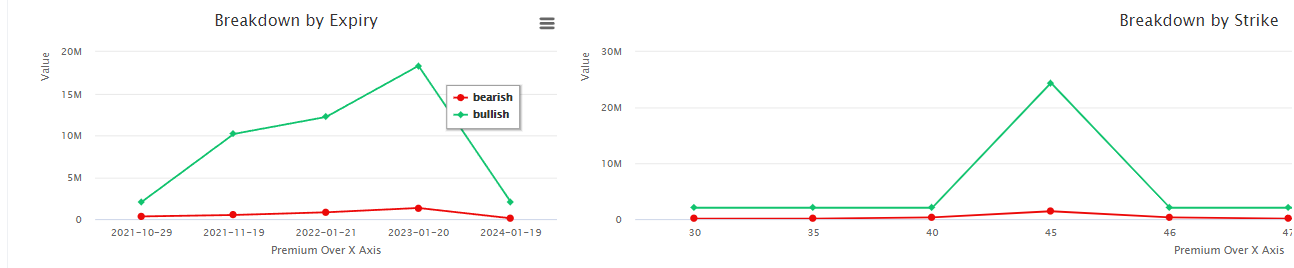

As seen, bullish premium accounts for 86.4% of the options chains, with 90.6% in call premium and 95.8% in ask-side orders.

To view more information about XPEV's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.