Unusual Options Activity in Flex Ltd. (FLEX), Barclays PLC (BCS), and Mullen Automotive, Inc. (MULN)

Unusual Options Activity in Barclays PLC (BCS)

Today, March 22, 2022, in the NYSE, there was unusual or noteworthy options trading activity in Barclays PLC (BCS), which opened at $9.22.

- There were a series of orders including sweeps on the $11 strike call option dated for September 16th, 2022, traded at the ask of $0.45 with a bid-ask spread of $0.40 to $0.45.

- The open interest on this chain was 353 contracts open and the overall volume is now approximately 10K.

- Of note, the largest sized order was 5,952 contracts, and then the sweeps thereafter ranging from 191 to 1,418 contracts traded, pictured below:

Additionally, these orders come after Trefis asked: “Barclays Stock Surpassed The Consensus In Q4, Is It A Buy?”

A tip from the flow: The ⚠️emoji means the size of the order was greater than the open interest on the chain itself.

Furthermore, these orders were also spotted on the NEW Unusual Whales hottest chains tool. As seen, the contracts had an acceleration factor of 1, implying there was a rapid increase in trading activity over open interest on this chain.

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

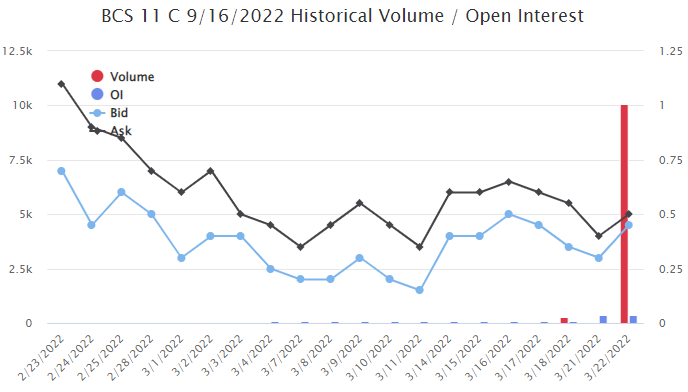

Seen above is the aforementioned chain’s historical volume, in red, and open interest, in blue, as bar charts behind the requisite bid and ask, in a light blue and darker shade, respectively.

The volume on this chain has now increased in excess over the open interest, so these contracts must have been bought or sold to open, not to close.

To view more information about BCS's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Flex Ltd. (FLEX)

In the NasdaqGS, there was unusual or noteworthy options trading activity in Flex Ltd. (FLEX), which opened today at $17.42.

- There were 841 contracts traded on the $18 and $17 strike call options dated for May 20th, 2022 and April 14th, 2022, respectively.

- The $18 strike chain had an open interest of 292 and now has a volume of approximately 841 (this order).

- The $17 strike chain had an open interest of approximately 2K and has the same volume.

- Therefore, it may be intuited that these orders are a roll, in which the trader is closing their $17 strike call options that are at a closer date, and then opening new positions on the later date, at a higher strike.

- Alternatively, this could be a diagonal spread, in which the $17 strike call is being sold to open, and the $18 strike is bought to open, split between the different strikes and expirations.

- Additionally, these orders come after Breakthrough Energy Ventures raised $65 million to speed U.S. plant plans, of which Flex was an existing investor.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

21.9% of the premium traded at these premium levels are in bullish bets, with 100% as ask-side orders, and 21.9% are in call premiums. Therefore, it can be seen that the majority of trades are in bearish bets.

To view more information about FLEX's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Mullen Automotive, Inc. (MULN)

Finally in the NasdaqCM, there was unusual or noteworthy options trading activity in Mullen Automotive, Inc. (MULN), which opened today at $2.99.

- There was repeated trading activity on the $3, $3.5, and $4 strike call options dated for April 14th and May 20th, 2022.

- Additionally, these orders come after InvestorPlace reported: “The Hype Behind Mullen Automotive Could Be Overplayed”.

Imgur: https://i.vgy.me/IG4CUN.png

Seen above are the noteworthy options in Mullen from the NEW Unusual Whale flow alerts tool.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

As seen, the open interest on this chain is 0, which indicates this completely novel volume, which can be one of the many indications into what makes unusual options activity.

To view more information about MULN's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.