Unusual Options Activity in Fluor Corporation (FLR), Caterpillar Inc. (CAT), and General Motors Company (GM)

Unusual Options Activity in Fluor Corporation (FLR)

Today, February 01, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Fluor, which opened at $21.13.

- 5,000 contracts traded as cross orders on the $22.5 strike call option dated for March 18th, 2022.

- These orders came in at a spot price of $1.20, or the ask price, with a bid-ask spread of $0.95 to $1.20.

- As stated, the orders in this report were cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

These orders come just after Simply Wall St begged the question: “Are Institutions Heavily Invested In Fluor Corporation's (NYSE:FLR) Shares?”.

Today’s volume has now overtaken open interest, so we can be rest assured that these orders were in fact to open, not to close; however, it cannot be known whether these orders will closed before the end of the day or not, and open interest as of tomorrow’s open will have to be reviewed to know if these traders remained in these positions or not.

Be mindful! Again, as stated, as these orders were cross trades, there is no reason to believe they were opened with a directional sentiment.

To view more information about FLR's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Caterpillar Inc. (CAT)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Caterpillar Inc. (CAT), which opened today at $200.80.

The following trades came in together, both with 2,500 contracts traded on the February 18th, 2022 expirations:

- $245 strike call options traded at a spot price of $0.16 with a bid-ask spread of $0.13 to $0.15.

- $237.5 strike call options traded at a spot price of $0.18 with a bid-ask spread of $0.17 to $0.19.

- Both sets of these 2,500 orders were traded above their open interests, which were 72 and 360 as of today’s open, respectively.

These orders come after Daniel Foelber from The Motley Fool labeled Caterpillar as “2 Wildly Undervalued Dow Dividend Stocks to Buy in February”.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade exclusively for their own account, it must be reported on an exchange by the "floor" tag. Click here to read about floor traders' performance.

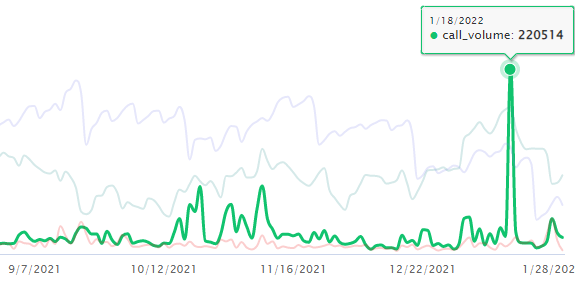

As of this writing, Caterpillar has had 19,836 calls traded, down from 220,514 calls traded on February 18th, 2022, which was extraordinarily outside of its standard deviation.

To view more information about CAT's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in General Motors Company (GM)

Finally, and again in the NYSE, we saw noteworthy options trading activity in General Motors Company (GM), which opened today at $52.85.

- There were 2,487 contracts traded on the $55 strike call option dated for February 4th, 2022--this week’s expiration.

- Of note, the volume on this chain is now greater than the open interest.

- Therefore, we cannot know if this trader opened these positions or not, but the volume on the chain has overtaken the open interest, revealing there is increased speculation on the $55 strike price for this week.

Additionally, these orders come after Zacks inquired: “Are Investors Undervaluing General Motors (GM) Right Now?”.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade is greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase). Be mindful! Trades without the briefcase emoji might still have been bought or sold to open!

What is noteworthy is that the volume yesterday, January 31st was of 6,195, and that volume did not last into the open interest into today, which is 5,112 contracts; therefore, we know this speculation is being traded intraday, and we might expect the same occurrence today with the reported trades above.

To view more information about GM's flow breakdown, click here to visit unusualwhales.com.

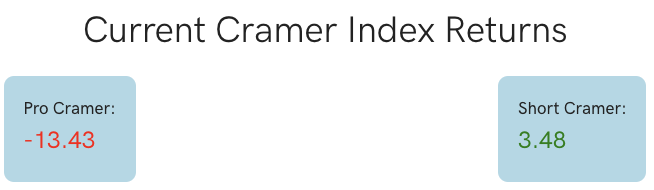

Have you visited the Cramer ETF yet?

The NEW Cramer ETF follows every Cramer Buy, and holds everything he holds, updating in real time.

Right now, he is -13%. Therefore, inversing Cramer's positions is up by comparison.

In the "How good is Jim Cramer" report:

- A “buy and hold” strategy on Cramer’s Mad Money buy recommendations since 2016 is unlikely to beat the market in the long run.

- Cramer’s show had a detectable impact on stock daily returns. More interestingly, we found the once lauded phenomenon known as the “Cramer Bounce” seems to now be a “Cramer Dive”.

- This decrease in immediate returns following Cramer’s recommendations may be due to a change in attitude by investment professionals.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.