Unusual Options Activity for Academy Sports and Outdoors (NASDAQ:ASO)

Nov. 4, 2021, 10:55am ET:

Yesterday, November 3rd, 2021, we observed significant unusual options activity for American sporting goods company, Academy Sports and Outdoors (NASDAQ:ASO).

- There were 51,848 call contracts transacted, versus a 5 day average of 3,311

- There were 10,000 contracts of the $50 call strike for December 17th, 2021 bought to open for a total of $2.6m

- And 10,000 contracts of the $60 call strike for December 17th, 2021 sold to open for a premium of $550k; seemingly a bullish multi-leg strategy

Unusual Whales wrote before about unusual options activity for ASO in a September 3rd Nasdaq article, outlining bullish sentiment. At the time, ASO traded at around $44.50. Today, November 4th, 2021, ASO is trading a bit higher, within a range of $47.34 and $47.96.

The overall call option trading volume for ASO yesterday was 51,848. This is roughly 6386% higher than the average of the previous 5 trading days (which was 3,311 call contracts transacted).

This unusual options activity was captured by the Unusual Whales flow tool yesterday afternoon, roughly 5 minutes before the end of market trading hours. 10,000 contracts of the $50 call strike for December 17th, 2021 were purchased on the ask side, whereas 10,000 contracts of the $60 call strike of the same expiration were sold on the bid side.

This appears to be an example of the options trading strategy called a “bull call spread”, wherein a trader buys one strike while simultaneously selling a higher strike of the same expiration.

This strategy indicates the trader predicted a limited upward movement for the ASO share price (the purchased $50 call contracts), while protecting shares or their position from downward movement (the sold $60 call contracts). A bull call spread limits the losses, but also caps gains within that range.

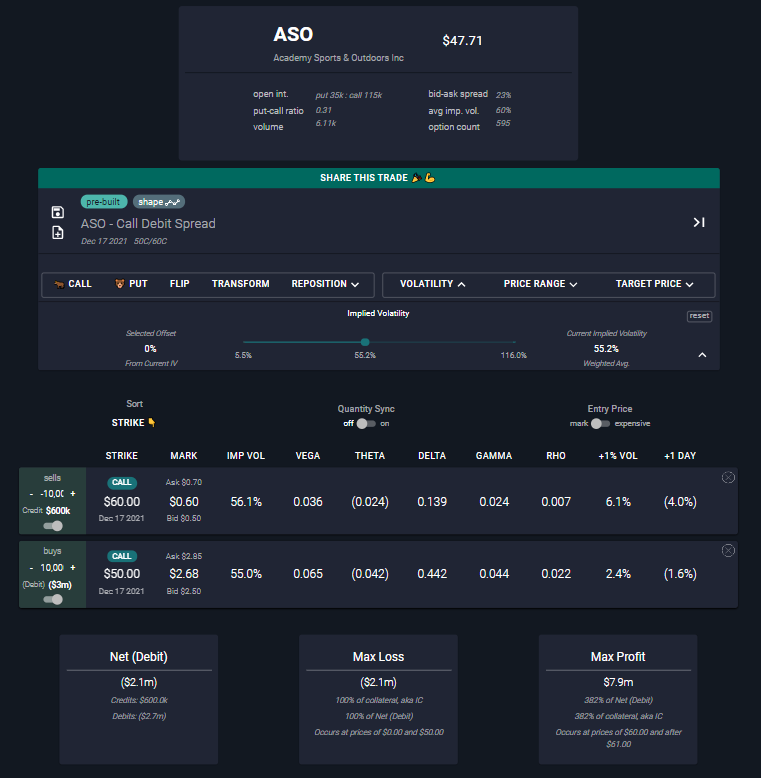

We can visualize this trade in the Unusual Whales Options Calculator. Pictured below, we can see that the max profit is limited to 382% ($7.9m in the case of this trade), occurring at a price of $60 per share, and after $61.

Unlike the purchase of naked calls, which have a theoretically infinite upside, and a downside of total loss, a bull call spread limits the maximum loss to the net cost of the strategy, but also limits the profit margin. The profit is the difference between the upper and lower strike prices, minus the premium paid ($2.1m in this trade), when the trade was opened.

Today in the Unusual Whales options flow tool, we see this sentiment continue somewhat.

Two large orders of 2,250 $55 strike calls and 2,250 $50 calls for November 26th, 2021 were bought to open on the ask side. Since there is no apparent aspect of this strategy limiting the downside, this play appears significantly bullish. After these contracts were opened, the Academy Sports and Outdoors share price rose slightly, from $47.67 to $47.94 before settling back down to the previously mentioned range.