Unusual Options Activity for Aecom (ACM)

October 28, 2021

10:55am ET

Over the last few days in the Unusual Whales flow, we’ve seen countless earnings related contract orders, both bullish and bearish. This is due to the fact that the majority (around 3/5ths) of S&P 500 big-tech companies report their earnings within the next two weeks (such as Apple (NASDAQ:AAPL), Advanced Micro Devices (NASDAQ:AMD), Alphabet (NASDAQ:GOOG), Amazon (NASDAQ:AMZN), and Twitter (TWTR). However, somewhat hidden amidst these giants and their colossal flow, some unusual options activity has been spotted.

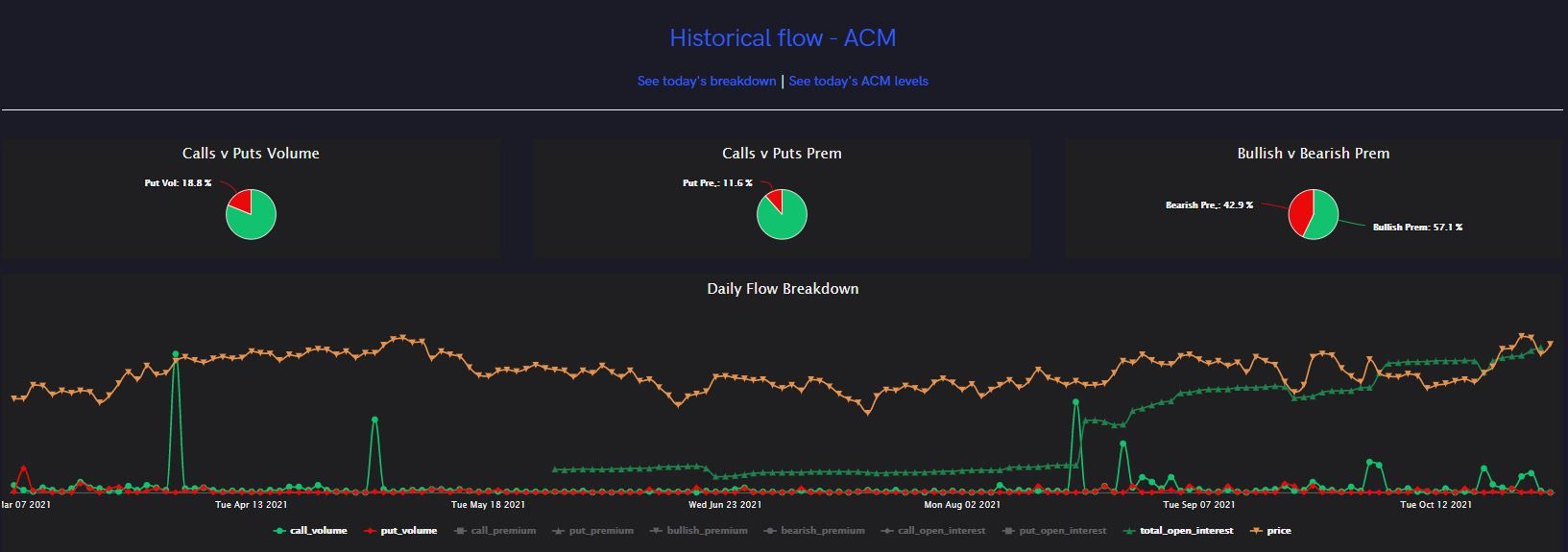

Aecom (ACM), a multinational engineering firm based in Los Angeles California, was one such example. From October 19th to October 26th, ACM call volume was significantly higher than its historical norm. Peaking at 5,446 call options traded on the 19th, notable volume appeared on October 25th and 26th, as well; all with overwhelming bullish sentiment (89% to 98% of premiums paid on any given day flagged as bullish).

The unusual options activity seems to have begun on October 19th, when ACM traded at around $63 per share. Options traders focused on the $70 call strike expiring in March of 2022; slightly long dated contracts, indicating an expectation for ACM to increase significantly in share price within the next 5 months. $196k total in premium was spent on the same strike and expiration.

On October 25th, unusual options flow captured by the Unusual Whales Flow tool indicated that traders had a heavy preference for the $70 call strike yet again; only this time with a much sooner expiration date of December 17th, 2021. Most notable of these were four orders at the top of the image below; one order for $40k in premium, two orders for $107k in premium, and one for $215k in premium, for 1,805 contracts in total, all for the same strike and expiration. At the time, ACM traded in the range of $68.30 to $69.18; up over $6 since the 19th.

Then, on October 26th, the unusual options activity continued. 1,350 total contracts of the $72.5 call strike (expiring November 19, 2021) and numerous smaller orders on the $67.5 call strike for the same date were captured by the flow. During this time, ACM maintained a share price above $69. This shows that, even after the month’s run, someone is still bullish on ACM’s future movement.

The options flow today is quite barren. The overall flow for ACM during the morning trading session totals 46 call contracts and 2 put contracts as of 10:46am ET. This could indicate that whomever opened the contracts over the last few days may still be holding onto them. Indeed, on October 26th, ACM tagged its all-time-high of $70.04 per share. The stock price today is a little back from that high, and is trading at $68.37 per share (+5.25% in the last 30 days). According to Nasdaq, ACM has an annual price target of $74.