Unusual Options Activity for Sabre Corp (SABR) Following Earnings

Monday, November 8th, 2021

11:00am ET

- Sabre Corp (NASDAQ:SABR) reported Q3 earnings on November 2nd

- SABR beat expectations on EPS, but missed revenue projections

- Post earnings, SABR tumbled 15%+

- Following the fall, unusual options activity was captured by the Unusual Whales Flow Tool

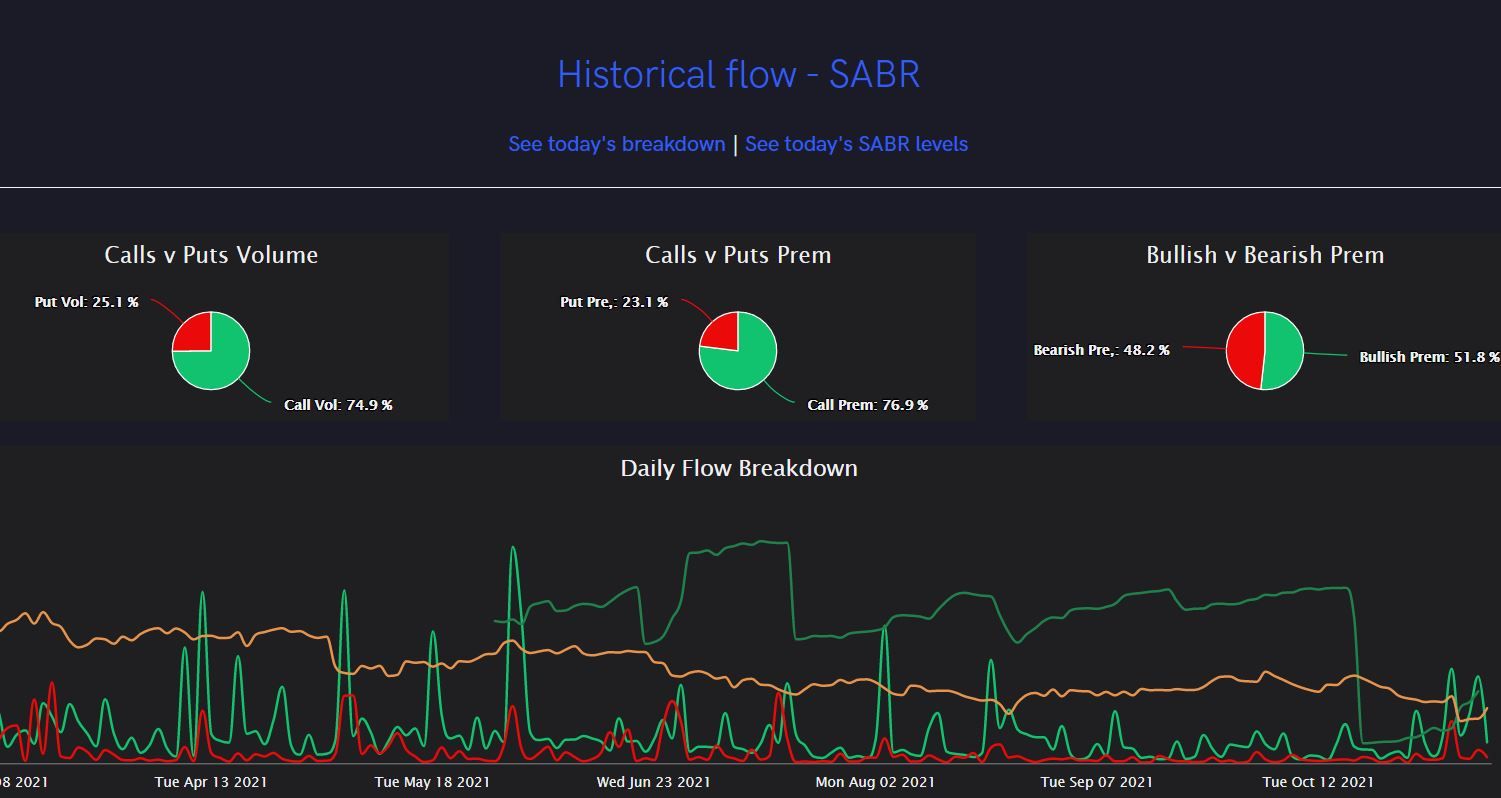

Since November 2nd, we’ve observed via the Unusual Whales Flow Tool unusual options activity for travel technology company, Sabre Corp (NASDAQ:SABR). Sabre Corp. is the largest global distribution systems provider for air bookings in North America, providing services to airlines. It was first created by American Airlines Group, Inc. (NASDAQ:AAL) and spun off into its own company in 2000.

On November 2nd, SABR reported its Q3 earnings, and despite a decent report (they reported a loss of $0.50 per share, vs. $0.55 per share (8.76% beat), and revenue of $441.09M vs. an expected $445.91M, a 1.08% miss) shares tumbled as far as 15%. SABR closed at $9.01 on November 2nd, down from $10.80 on the previous day’s close.

The options flow, however, captured a notably unusual options transaction that carried with it a double feature of bullish sentiment.

The image above, taken from the Unusual Whales Flow Tool, 5,000 contracts of the $13 call strike expiring December 17th, 2021 were bought to open on the ask side. However, the orders below this are most notable. A trader or investor bought 2,740 contracts of the $10 and $12 call strikes for December while simultaneously selling the $9 put strike of the same expiration date. As we’ve discussed before, a sold put on the bid side, and a call purchased on the ask side, are both generally bullish trades. In this case, with both opened in this fashion, the sentiment is perhaps even more bullish.

This strategy is called a “risk reversal”, wherein a trader buys a call and sells a put at the same time. This indicates bullish expectations of the stock to “reverse” off the downtrend it experienced following their earnings report. Since this strategy can also simulate the profit / loss of owning the actual stock, and is sometimes referred to as a “synthetic long”. In addition to this strategy, the Unusual Whales Flow tool caught yet another example of bullish unusual options activity.

Pictured above, someone bought 1,939 contracts of the $9 put strike expiring on November 19th, 2021, while simultaneously selling the $10 put strike expiring December 17th, 2021. The total premium for the sold put was $194k, versus a total premium of $54k for the purchased put contracts. This strategy used on SABR is called a “put calendar spread.” Via this strategy, an investor expects the stock to go up. Ideally, the put contracts that they sold (the $10 strike for 12/17) would expire worthless; thus allowing the trader to pocket the premium they were given for selling those puts.

It definitely makes sense that such bullish sentiment has been captured in the Flow. As mentioned, SABR is the biggest airlines software company. Given the fact that airlines are coming back in a big way, it only makes sense that SABR stands to benefit in similar fashion to the increase in air travel.

Since this flow was captured by Unusual Whales, the SABR share price has bounced back. Today, the stock has traded as high as $10.43 after an open price of $10.03.