Unusual Options Activity for Uranium Miner Cameco Corp. (CCJ) Maintains Last Week's Bullish Sentiment

11:04AM ET: Last week, Unusual Whales covered some of the unusual options activity on Uranium Miner Cameco Corp CCJ in a Nasdaq article. At the time, CCJ was trading at $19.49, while at the time of writing this article, CCJ is trading at $22.22 per share, having reached a morning high of $22.25. On Friday (9/3), CCJ continued to see massive volume on call contracts, with ask-side call orders flowing heavy right up until close. In the figure below, we can observe new highs in call volume on every single day since the original Nasdaq article was published.

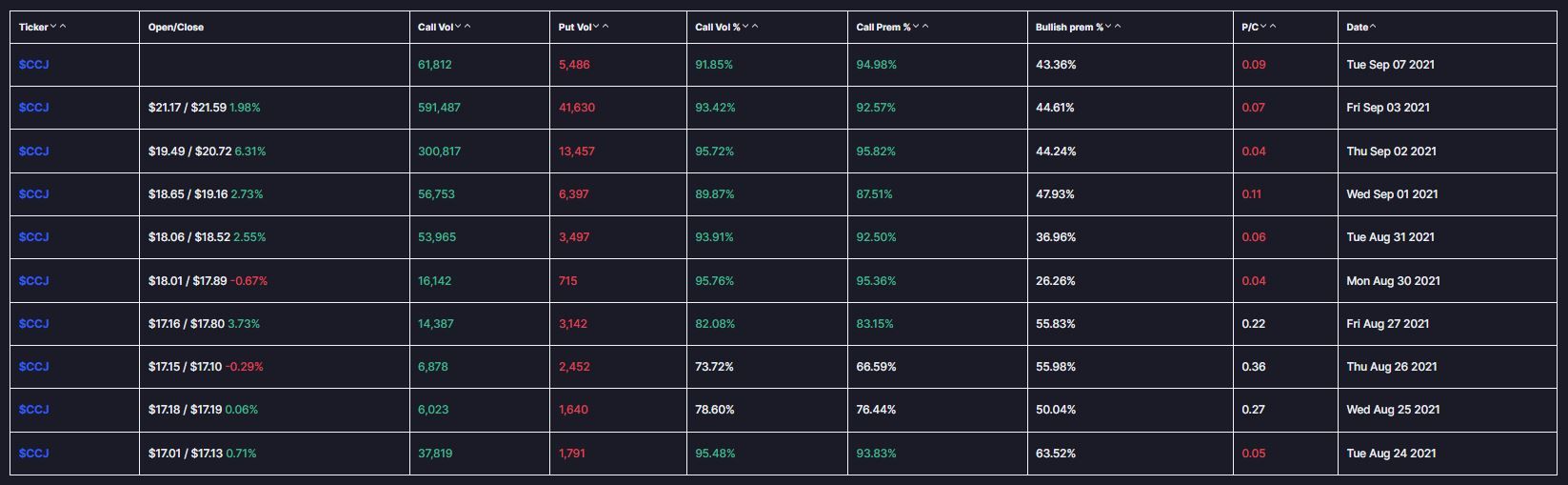

Via this image from the Unusual Whales Historical Flow for CCJ, we can see the massive influx of volume began on Tuesday, August 31st, reaching 53,965 in call volume; over 3x the previous day’s volume. Two days later, volume increased by a similar factor, reaching 300,817 on September 2, 2021, then nearly doubled on Friday, September 3rd, reaching a high of 591,487 call option transactions. As we see in the options Flow on Friday, the majority of these orders came in on the ask-side, indicating bullish expectations for CCJ.

Orders on Friday showed a heavy preference for $20 calls expiring in September. Right up until close, flow consistently indicated an expectation for CCJ to continue rising; having already risen over $1 from the publication of Unusual Whales’ previous article on CCJ. This morning, September 7, 2021, ask-side options flow maintains a bullish-leaning stance, now with preference to the $25 and $27 call options expiring in December 2021 and January 2022.

As uranium prices rise higher, it will be interesting to see what happens with Cameco flow. Will investors stay bullish? Based on the flow, for the time being the bullish sentiment is holding; but time, patience, and eyes on the flow will show what happens next.