Unusual Options Activity in Fossil Group, Inc. (FOSL), Advanced Micro Devices, Inc. (AMD), and Annaly Capital Management, Inc. (NLY)

Unusual Options Activity in Fossil Group, Inc. (FOSL)

Today, February 02, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Fossil Group, which opened at $11.47.

The following orders came in together as 7,000 contracts each and dated for March 18th, 2022:

- $8 strike put options bought to open at the ask of $0.35 with a bid-ask spread of $0.15 to $0.35. The open interest on this chain was approximately 742, so we can intuit these orders were to open.

- $12 strike call options traded at the ask of $1.05 with a bid-ask spread of $0.80 to $1.05. The open interest on this chain was approximately 9,000 as of today’s open, so it cannot be known whether this set of 7,000 contracts in this order were to open or to close.

These orders come just after Simply Wall St reported: “There's Been No Shortage Of Growth Recently For Fossil Group's (NASDAQ:FOSL) Returns On Capital”.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance. Here is a snippet:

“More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.”

Of note, the volume on January 31st, 2022 rather matches the volume today, at least in part; as the open interest was maintained since then into today, one could speculate as to whether this is more, novel volume opening positions on this chain or if the trader is exiting the position they had opened on the 31st.

To view more information about FOSL's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Advanced Micro Devices, Inc. (AMD)

Again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Advanced Micro Devices, Inc. (AMD), which opened today at $129.89.

The following cross trades came in together as 15,000 contracts traded on each chain:

- $115 strike call options bought to open at the ask of $21.15 with a bid-ask spread of $21.00 to $21.15. The open interest on this chain was approximately 6K, so it can therefore be intuited that these contracts were either bought or sold to open, not closed.

- $135 strike call options traded at a spot price of $5.75 with a bid-ask spread of $5.75 to $5.85. The open interest on this chain was approximately 29K and the volume thus far on the chain is approximately 17K, so it cannot be known whether these contracts were opened or closed as of this order.

As stated, the orders in this report were cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

These orders come after Neil Rozenbaum from The Motley Fool explained that AMD “beat estimates across the board with record annual revenue and profitability.”

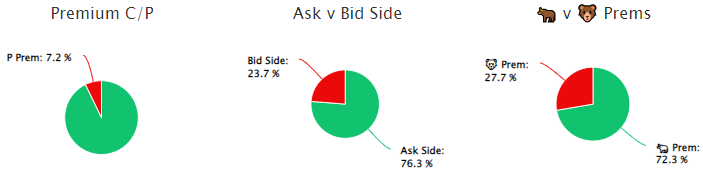

72.3% of the premium traded is in bullish premium, with 76.3% as ask-side orders, with only 7.2% of the volume of options premium being in puts. The put call ratio for AMD is 0.37.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about AMD's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Annaly Capital Management, Inc. (NLY)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in $7.87.

There were two floor trades that came through whose total contracts traded were above the open interests on their chains:

- 10,000 contracts on the $7.5 strike put option dated for March 11th, 2022, bought to open above the ask at $0.17 with a bid-ask spread of $0.10 to $0.14.

- 20,000 contracts on the $8 strike call option dated for April 14th, 2022, sold to open at the bid of $0.15 with a bid-ask spread of $0.15 to $0.20.

Additionally, these orders come just ahead of Annaly reporting its earnings on February 9th, 2022 after market close.

The aforementioned orders of the $8 strike call options and $7.5 strike put options are the most traded with volumes surpassing any other volume on Annaly’s options chains overall.

To view more information about NLY's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.