Unusual Options Activity in Futu Holdings Limited (FUTU), Rivian Automotive, Inc. (RIVN), and Petróleo Brasileiro S.A. - Petrobras (PBR)

Unusual Options Activity in Futu Holdings Limited (FUTU)

Today, January 27, 2022,in the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in Futu, which opened at $39.82.

The following orders on the $35 strike call option came in separately in order sizes of varying amounts from 615 to 992 contracts at a time, all dated for tomorrow, January 28th, 2022, traded at various spot prices from $3.98 to $4.40 with a volatile bid-ask spread of anywhere from $3.80 to $4.50.

These orders come just after David Bartosiak of Zacks stated Futu was its Bear of the Day.

There has been nearly no volume on this chain prior to this date, with but 1 to 17 contracts traded up until this morning’s open, in which the 3,759 novel volume has come in.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Be mindful! Trades without the briefcase emoji might still have been bought or sold to open! You may also watch this video to see how to track these kinds of opportunities in the Unusual Whales flow.

Furthermore, just because these orders were indeed opened, it cannot be absolutely known whether these calls were sold to open or bought to open.

To view more information about FUTU's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Rivian Automotive, Inc. (RIVN)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS) Rivian Automotive, Inc. (RIVN), which opened today at $61.33.

Two orders came in together in the amount of 2,500 contracts bought to open at the ask, dated for May 20th, 2022:

- $90 strike call options at a spot price of $4.35 with a bid-ask range of $3.05 to $4.40.

- $80 strike call options at a spot price of $6.10 with a bid-ask range of $5.05 to $6.15.

These orders come after Tesla ($TSLA) reported its Q4 earnings yesterday, as well as announcing delays in its Cybertruck launch until 2023. It is still unclear who will come out on top as the runner up in the EV market this year.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance. Here is a snippet:

“More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.”

80.78% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, the $5,000 premium levels are in bullish premiums at 62.21%, with a similar amount of call and put premiums traded. As can be seen, the overall options order flow on Rivian is bullish.

To view more information about RIVN's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Petróleo Brasileiro S.A. - Petrobras (PBR)

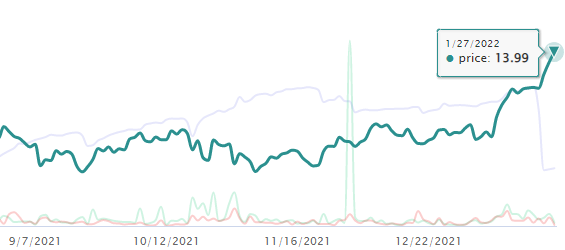

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Petróleo Brasileiro S.A. - Petrobras (PBR), which opened today at $13.95.

- There were 10,000 contracts traded on the $13.5 strike call options dated for February 18th, 2022.

- These contracts were swept at a mid price of $0.71 with a bid-ask range of $0.55 to $0.95.

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

Additionally, these orders come after Zacks Equity Research reported Petróleo Brasileiro has reduced its 2022-26 production targets.

Petróleo Brasileiro’s price has dramatically increased since our first report, however, open interest today has declined to 1,861,641 contracts open in circulation since its previous high of 3,083,454 open interest on January 21st, 2022.

To view more information about PBR's flow breakdown, click here to visit unusualwhales.com.

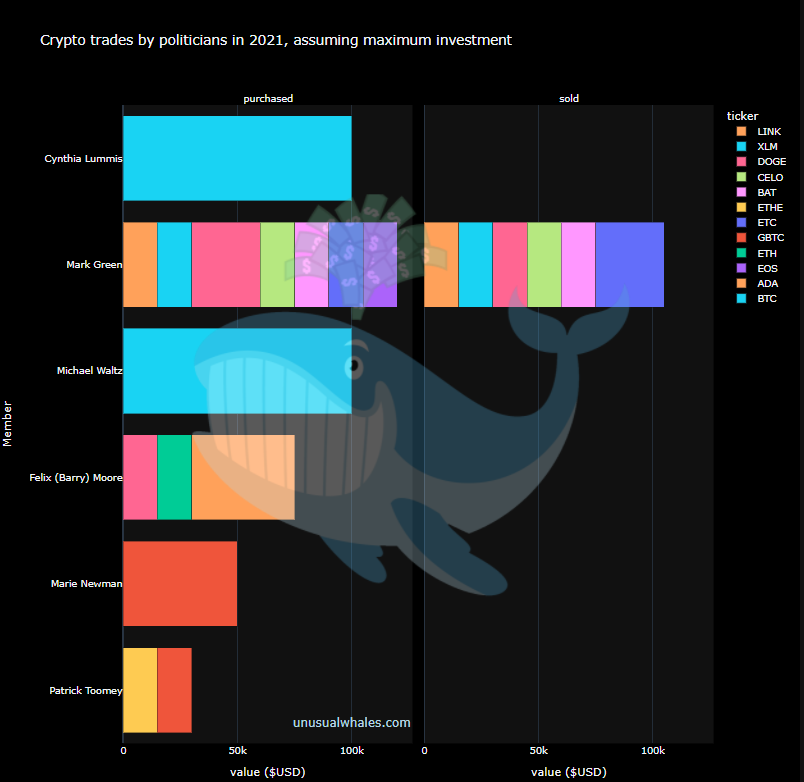

Have you read the Congress and Crypto in 2021 Report yet?

In 2021, members of Congress started accumulating crypto in their personal portfolios, and introduced more bills than ever focusing on crypto policy, 35 of them to be exact.

In 2021, Congress traded:

- $290,000,000 in stocks

- $140,000,000 in options

- $124,000,000 in other securities (PE funds and crypto)

While not overwhelmingly backed by Congress, there is valid and legitimate support from members hinting that future support for cryptocurrency is on the way. Though these members directly involved in crypto only total six, 29 total members have participated in trades involving cryptocurrency or cryptocurrency related companies, suggesting support for pro-crypto legislation might be higher in 2022.

Click here to read the full report for all of the details.

And for more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.