Unusual Options Activity in Groupon, Inc. (GRPN), Kaleyra, Inc. (KLR), and Diamondback Energy, Inc. (FANG)

Unusual Options Activity in Groupon, Inc. (GRPN)

Today, February 23, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual activity in Groupon, Inc. (GRPN), which opened today at $22.68.

- There were 1,823 contracts cross traded on the $25 strike call options dated for March 18th, 2022.

- These orders are unusual as the chain had 653 open interest as of this morning, implying the traders here are the first to open positions on this chain historically, in spite of these being aggregated orders.

Additionally, these orders come ahead of Groupon reporting its earnings February 28th, 2022 after the market closes.

As stated, the orders in this report were cross trades:

Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

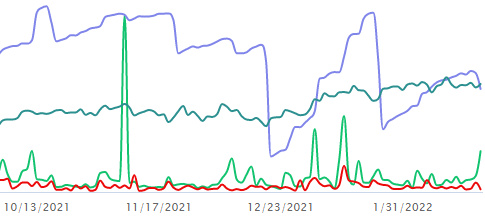

As seen, the volume, in red, has overtaken the open interest, in blue, which implies that more contracts are being opened on this chain than closed.

To view more information about GRPN's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Kaleyra, Inc. (KLR)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Kaleyra, which opened at $8.40.

- There have been a series of orders on the $7.5 strike call option dated for March 18th, 2022; however, the sizes of the orders have not been greater than the open interest on the chain, so these might be intuited as either to open or to close.

However, there has been a 181% increase in call volume today over Kaleyra’s average 30-day volume from these orders, and unusual volume can be indicative of traders setting up novel positions in spite of existing open interest.

Additionally, these orders come after Zacks Equity Research reported on Kaleyra’s Q4 earnings:

“This quarterly report represents an earnings surprise of 19.05%. A quarter ago, it was expected that this company would post a loss of $0.13 per share when it actually produced a loss of $0.29, delivering a surprise of -123.08%.”.

66.9% of the premium traded at these premium levels are in bullish bets, with 70.9% as ask-side orders, and 96% are in call premiums. The put call ratio for Kaleyra is 0.02, which might imply this ticker has illiquid options volume, in spite of how bullish it appears.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about KLR's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Diamondback Energy, Inc. (FANG)

Finally, and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Diamondback Energy, Inc. (FANG), which opened today at $129.56.

- There were 4,500 contracts traded on the $140 strike call option dated for January 20th, 2023, bought to open at the ask of $23.40 with a bid-ask spread of $20.00 to $23.90.

- The open interest on this chain was approximately 1.1K contracts open this morning, and the premium traded in this single lot was approximately $10.5M.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance. Here is a snippet:

“More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.”

As of this writing, Diamondback Energy has had 18,254 calls traded, which is 261% greater than its 30-day call average.

To view more information about FANG's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.