Unusual Options Activity in Healthcare Trust of America, Inc. (HTA), Opendoor Technologies Inc. (OPEN), and Apple Inc. (AAPL)

Unusual Options Activity in Healthcare Trust of America, Inc. (HTA)

Today, November 23, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Healthcare Trust of America, Inc., which opened at $34.35.

- The unusual activity came in on the $35 strike call options, above the ask, dated for January 21st, 2022.

- There were 5,993 contracts swept together, meaning brokers split the order(s) apart to take advantage of order sizes at the best prices being offered.

- What is noteworthy about these orders is that they were traded above the ask, at a spot price of $1.10, whereas the bid-ask was $0.90 to $1.05 on these contracts.

- These contracts altogether represent approximately 599,300 shares and $659,110 in premium traded.

These orders come after Healthcare Trust of America, Inc. reported its Q3 earnings.

As of this writing, Healthcare Trust of America, Inc. has had 6,760 calls traded, which is roughly over 423% greater than its 30-day call average.

To view more information about HTA's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Opendoor Technologies Inc. (OPEN)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Opendoor Technologies Inc. (OPEN), which opened today at $18.20.

- There were 15,000 contracts that appeared to be closed on the $18.5 strike put option dated for November 26th, 2021, and were rolled as a new 16,500 contracts to the $17.5 strike put option dated for December 3rd, 2021.

- These contracts represent approximately 3,150,000 shares and $4,300,000 in premium traded.

These orders came after Matthew Frankel of The Motley Fool stated: “What I'd like to see Zillow do is become the Kayak of iBuying, where they partner with Opendoor and Offerpad and Redfin.”

53.6% of the premium traded at these premium levels are in bullish bets, with 53.6% as bid-side orders, and 100% are in put premiums.

To view more information about OPEN's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Apple Inc. (AAPL)

Finally, and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in Apple Inc. (AAPL), which opened at $161.12.

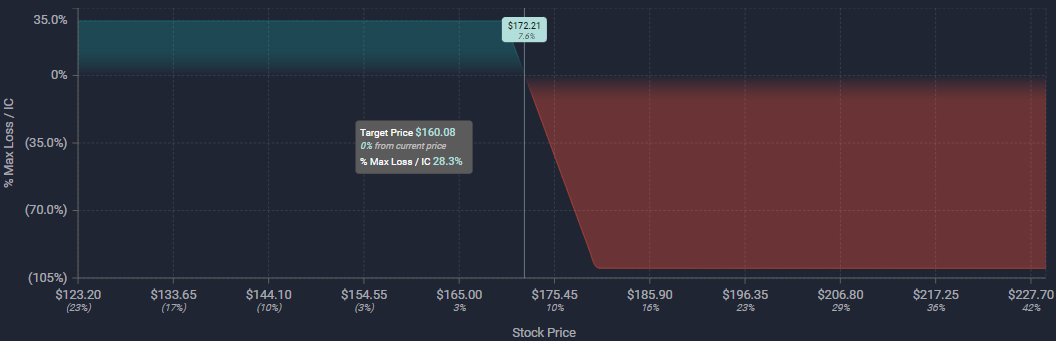

- There were 10,2000 contracts traded on the $180 strike call option, bought to open at the ask, dated for February 18th, 2022..

- Additionally, there were another 10,200 contracts traded on the $170 strike call option, at the bid, for the same date.

- These contracts altogether represent a call credit spread, approximately 2,040,000 shares and $5,600,000 in premium traded.

These orders came after Daniel Foelber and Danny Vena of The Motley Fool opined that Apple Inc.,

“With more than 1 billion active iPhones worldwide, that suggests as many as 250 million iPhone users could trade in their old device for a new one in the coming months.”

To view more information about AAPL's flow breakdown, click here to visit unusualwhales.com.