Unusual Options Activity in Helmerich & Payne, Inc. (HP), Nucor Corporation (NUE), and Ford Motor Company (F)

Unusual Options Activity in Helmerich & Payne, Inc. (HP)

Today, February 04, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in HP, which opened at $30.61.

- There were 7,950 contracts bought to open above the ask on the $35 strike call option dated for March 18th, 2022 at a spot price of $0.90 with a bid-ask spread of $0.70 to $0.80.

These orders come just before HP goes ex-dividend on February 10th, 2022.

A tip from the flow: Beware of ex-dividend dates! You might want to avoid trading calls surrounding a stock's ex-dividend date, even if the options order flow shows a lot of call volume:

You might be seeing traders that are looking to capture as much of the dividend as possible, who are looking to exercise deep ITM call options.

Of note, these orders were first found via the Unusual Whales Hottest Chains v2 page:

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

To view more information about HP's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Nucor Corporation (NUE)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Nucor Corporation (NUE), which opened today at $112.56.

The following cross trades came in together as 2,500 contracts traded on the July 15th, 2022 expirations:

- $140 strike call options traded close to the ask at a spot of $4.69 with a bid-ask spread of $4.30 to $5.00. The open interest on this chain was approximately 1K contracts, so it can therefore be intuited that these contracts were either bought or sold to open, not closed, as the size of the trade itself was greater than the existing contracts.

- $90 strike put options traded close to the bid at a spot price of $4.59 with a bid-ask spread of $4.40 to $4.85. The open interest on this chain was approximately 121, so these were also opened as of this order.

As stated, the orders in this report were cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

These orders come after RTTNews reported Nucor’s “board approved a $290 million investment to expand the product capabilities of its Crawfordsville, Indiana steel sheet mill by adding a construction grade continuous galvanizing line and prepaint line.”.

94.37% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, the $5,000 premium levels are in bullish premiums at 90.98%, albeit with a similar amount of call and put premiums traded. As can be seen, the overall options order flow on Nucor is bullish.

To view more information about NUE's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Ford Motor Company (F)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Ford Motor Company (F), which opened today at $18.52.

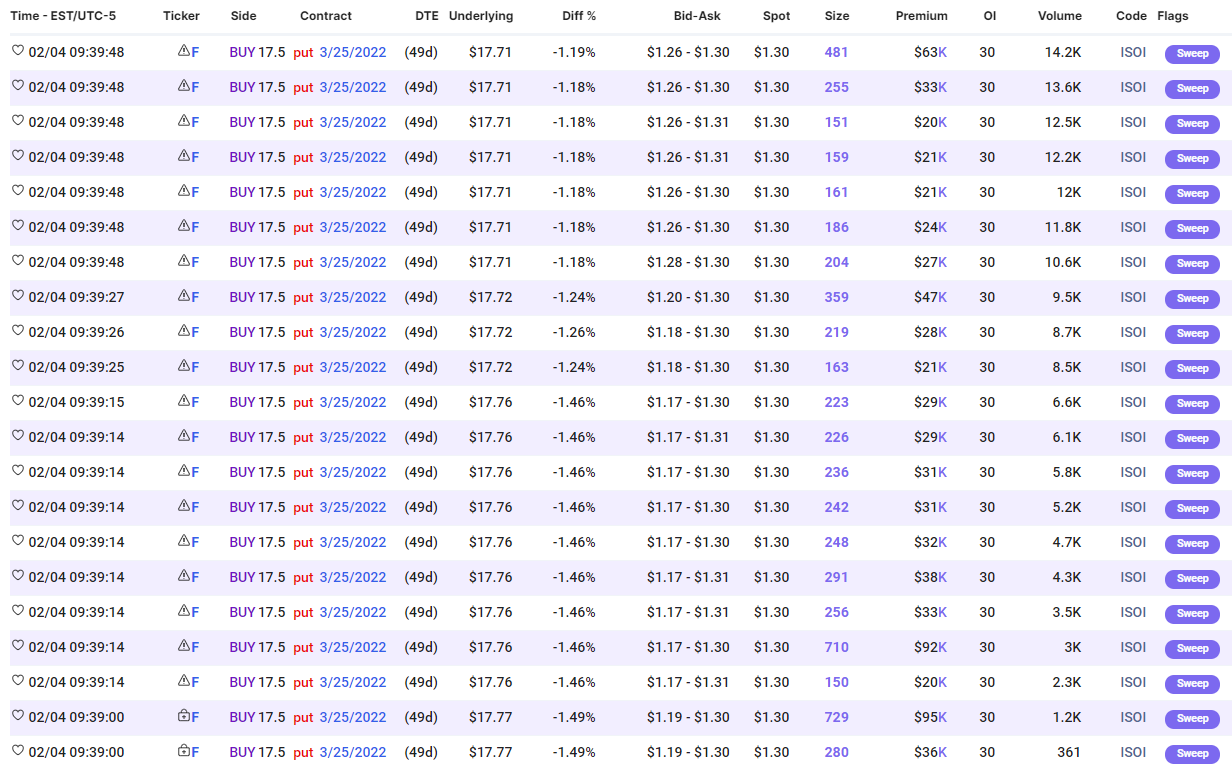

There were sweep-to-fill orders on the $17.5 strike put options dated for March 25th, 2022 bought to open at the ask at a spot price of $1.30 with a bid-ask spread of $1.26 to $1.30.

Of note, these orders were first found via the Unusual Whales Hottest Chains v2 page:

Additionally, these orders come after Zacks Ford “reported adjusted earnings of 26 cents per share for fourth-quarter 2021, missing the Zacks Consensus Estimate of 43 cents”.

41.4% of the premium traded is in bullish bets, with 19% of the premium traded is in calls, with 58% as ask-side orders. The put call ratio for HP is 0.836, which is becoming bearish.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about F's flow breakdown, click here to visit unusualwhales.com.