Unusual Options Activity in Hilton Worldwide Holdings Inc. (HLT), Activision Blizzard, Inc. (ATVI), and IonQ, Inc. (IONQ)

Unusual Options Activity in Hilton Worldwide Holdings Inc. (HLT)

Today, November 17, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Hilton Worldwide Holdings Inc., which opened at $140.81.

There were 1,840 contracts traded on the $145 strike call option, bought to open at the ask, dated for May 20th, 2022.

These contracts represent approximately 184,000 shares and $2,400,000 in premium traded.

These orders come after Mr. Brock Ladenheim from TipRanks explained that:

By inspecting hilton.com’s traffic data on TipRanks, an upward quarter-over-quarter trend can be identified. From Q2 to Q3, total visits from all devices increased 6.92%, while the share price gained 9.53%. Looking at longer-term ranges, visits are up 31.32% from the year-to-date period of 2020 compared to the same months of 2021. This positive statistic signals a steady recovery from the investor fears of last year.

92.9% of the premium traded at these premium levels are in bullish bets, with 92.9% as ask-side orders, and 100% are in call premiums.

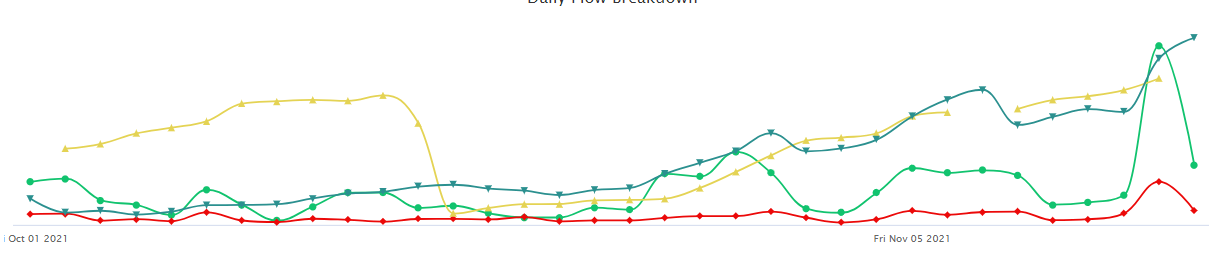

To view more information about HLT's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Activision Blizzard, Inc. (ATVI)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Activision Blizzard, Inc. (ATVI), which opened today at $65.53.

There were 1,968 contracts traded on the $65 strike call option, dated for January 20th, 2023, bought at the ask.

Additionally, there were another 1,968 contracts traded on the $85 strike call option, for the same date, sold at the bid; however.

These contracts represent a long-dated call debit spread, approximately 393,600 shares, and $2,656,000 in premium traded.

These orders after RTTNews’ reports that Activision Blizzard, Inc. (ATVI) is under strict intense scrutiny by law enforcement for repeated allegations of sexual harassment and misogyny..

It cannot be ascertained if the short side calls on the $60 strike were in fact sold to open, but if they were, this is how the strategy would be visualized prior to the short side expiration, on November 18th, 2021.

To view more information about ATVI's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in IonQ, Inc. (IONQ)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity today in IonQ, Inc. (IONQ), which opened at $26.30.

There were 800 contracts traded on the $30 strike call option, at the ask, dated for November 19th, 2021.

There were an additional 800 contracts traded on the $30 strike put option, sold to open at the bid, for the same date; these contracts’ order size was greater than the chain’s open interest.

These orders, if they were indeed traded as part of a strategy, represent a synthetic long, approximately 160,000 shares and $480,000 in premium traded.

It is worth noting that additional orders could have been traded as a part of a greater strategy in addition to the two legs reported above.

Furthermore, these orders come after Mr. Chris Neiger from The Motley Fool explained: “Investors appear to be very happy that management raised IonQ's guidance for full-year bookings guidance for the second time in two months.”

As of this writing, IonQ, Inc. has had 24,333 calls traded, down from 73.060 calls traded yesterday, today’s volume thus far is 208% greater than its 30-day call average.

To view more information about IONQ's flow breakdown, click here to visit unusualwhales.com.