Unusual Options Activity in HP Inc. (HPQ), General Dynamics Corporation (GD), and PayPal Holdings, Inc. (PYPL)

Unusual Options Activity in HP Inc. (HPQ)

Today, March 24, 2022, in the NYSE, there was unusual or noteworthy options trading activity in HP Inc. (HPQ), which opened at $37.85.

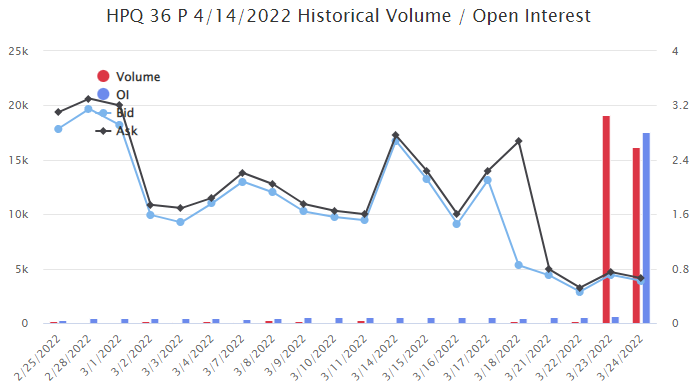

- There was repeated trading activity on the $36 strike put options dated for April 14th, 2022, traded at a spot price of $0.66 with a bid-ask spread of $0.55 to $0.71.

- By observing the flow, it can be deduced that these orders might be puts being bought to close, as the open interest on this chain is approximately 17.6K and the volume of these orders have only amounted to approximately 12.3K.

- Additionally, these orders come after Zacks explained why HP (HPQ) is a Strong Momentum Stock.

A tip from the flow: When viewing alerts in the Unusual Whales flow, you can click the order’s option contract expiration to open another panel which has three additional charts and a table to take a deeper dive into the company’s overall intraday options volumes, the chain’s bid-ask pressures, and historical volumes and open interests.

As stated, these orders significant sizes have not yet overtaken the open interest on the chain itself:

In conclusion, the red volume is less than the blue open interest, and the volumes today are similar to those yesterday; therefore, intuition can tell us that these orders might be getting closed today. This shows how the flow can be used to follow a trade from beginning to end, tracking orders as they are sold to open and bought to close, or any variant therein.

N.B., there is always the possibility this volume is in fact new volume on the chain being opened--only by observing the open interest tomorrow following these steps can we be completely certain.

To view more information about HPQ's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in General Dynamics Corporation (GD)

In the NYSE, there was unusual or noteworthy options trading activity in General Dynamics Corporation (GD), which opened today at $240.00.

- There were two orders traded above the ask on the $250 strike call options dated for January 20th, 2023.

- The bid-ask on this chain was $16.30 to $18.00 and these trades were at a spot price of $18.40.

- The open interest on this chain was 144 as of today and the overall volume is now 275.

Additionally, these orders come after Zacks reported that on Tuesday:

“General Dynamics (GD) closed at $237.83 in the latest trading session, marking a +0.75% move from the prior day. This move lagged the S&P 500's daily gain of 1.13%. Elsewhere, the Dow gained 0.74%, while the tech-heavy Nasdaq added 0.87%.”

Please note, trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market.

Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

92.5% of the premium traded at these premium levels are in bullish bets, with 97.5% as ask-side orders, and 93.6% are in call premiums.

To view more information about GD's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in PayPal Holdings, Inc. (PYPL)

Finally in the NasdaqGS, there was unusual or noteworthy options trading activity in PayPal Holdings, Inc. (PYPL), which opened today at $115.82.

- There were two sets of cross trades on the April 14th, 2022 expiration for the $115 strike put and $115 strike call. The calls were bought to open at the ask and the puts were sold to open at the bid. The volumes on both of these chains are now above their open interests, implying some number of these contracts are indeed to open.

- Additionally, these orders come after Motley Fool listed PayPal was one of the “4 Growth Stocks Down 56% or More”.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated:

As stated, the orders in this report were cross trades:

Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

To view more information about PYPL's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.