Unusual Options Activity in Barclays PLC (BCS), Banco de Chile (BCH), and General Motors Company (GM)

Unusual Options Activity in Barclays PLC (BCS)

Today, January 20, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Barclays, which opened at $11.33.

The following orders came in together, each as 6,017 contracts traded, all dated for March 18th, 2022:

- $11 strike put options bought to open at the ask.

- $12 strike put options sold to open at the bid.

- $12 strike call options bought to open at the ask.

Altogether, this represents a bullish put credit spread and a long call. It would be expected these trades are alongside shares held at a lower spot price.

These orders come just after reports that Barclays had approached new all-time highs.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

As of this writing, Barclays has had 20,457 puts traded, which is 2,387% greater than its 30-day put average.

To view more information about BCS's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Banco de Chile (BCH)

Again in the NYSE, we saw unusual activity in Banco de Chile (BCH), which opened today at $18.73.

The following orders came in together, each as 7,376 contracts traded:

- $27 strike call options, dated for April 14th, 2022, traded at a spot price of $2.05 with a bid-ask spread of $1.87 to $2.10.

- This chain had an open interest of approximately 15,000 as of this morning’s open, so it is not possible to ascertain whether these orders were to open or close these contracts.

- $27 strike call options, dated for July 15th, 2022, bought to open at the ask of $2.90, with a bid-ask spread of $2.63 to $2.98.

- This chain, however, had an open interest of 399 contracts open this morning, so therefore we can intuit these as having been opened.

Altogether, this either could be a trader rolling their April expiration positions out to July, or a calendar spread that was somehow able to have its front expiration sold to open at or near the ask.

You may watch this video to see how to track these kinds of trades and opportunities in the Unusual Whales flow.

These orders come after continuing volatility in the crypto markets, with Banco de Chile playing no small part in the conversation surrounding cryptocurrency and nations’ understanding of them.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest. Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Be mindful! Trades without the briefcase emoji might still have been bought or sold to open!

97.39% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, the $5,000 premium levels are in bullish premiums at 98.04%, with over $3.8M in premium traded.

To view more information about BCH's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in General Motors Company (GM)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in General Motors Company (GM), which opened today at $56.02.

The following orders came in together, each as 14,000 contracts traded, both dated for April 14th, 2022. Of note, both of these trades’ sizes and the total volumes on the chains are greater than the chains’ open interests as of this morning.

- $60 strike call options bought to open at the ask of $3.05 with a bid-ask spread of $2.93 to $3.00.

- $70 strike call options sold to open at the bid of $0.85 with a bid-ask spread of $0.83 to $0.88.

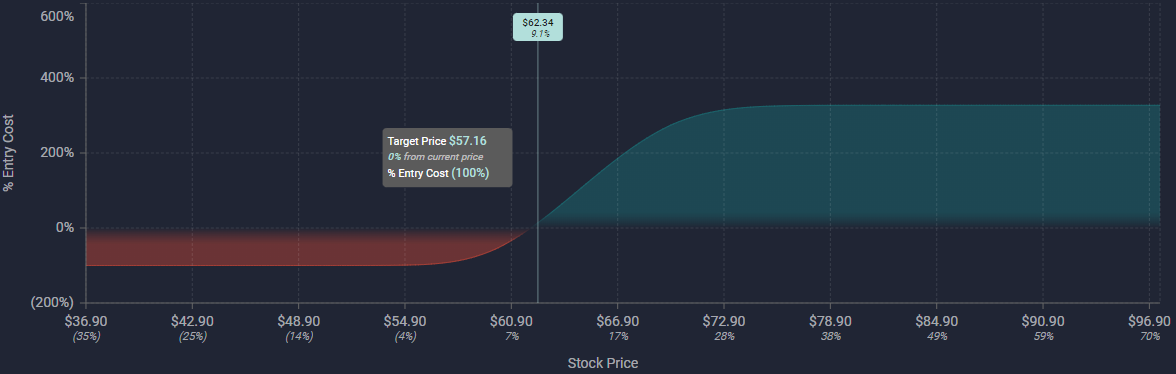

Altogether, these orders represent a bullish call debit spread, with a limited risk (the cost of entering into the position) and potential upside return.

These orders come after Zacks Equity Research reported that General Motors “recently launched new commercial applications of its Hydrotec fuel cell technology”.

As aforementioned, visualized now above, is the limited downside risk and the upside potential of this strategy. The maximum loss for this trader would be approximately $3.3M, the debit paid, and the maximum profit would be $10.7M, occurring as General Motors’s stock price moves past $70.00.

To view more information about GM's flow breakdown, click here to visit unusualwhales.com.