Unusual Options Activity in Bath & Body Works, Inc. (BBWI), Ball Corporation (BLL), and Citigroup Inc. (C)

Unusual Options Activity in Bath & Body Works, Inc. (BBWI)

Today, January 25, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Bath & Body Works, which opened at $55.28.

The following orders came in together as 2,000 contracts traded:

- $52 strike put options dated for February 11th, 2022, bought to open at the ask at a spot of $2.50 with a bid-ask range of $1.85 to $2.80.

- $51 strike puts options dated for January 28th, 2022, traded at the bid at a spot of $0.62 with a bid-ask range of $0.55 to $0.81. The size and volume of these orders have not surpassed the open interest on the chain, which was already approximately 8,000.

Altogether, it would appear this trader is rolling their contracts out to a later date and a higher strike price.

These orders come just after reports from Ananya Mariam Rajesh of Reuters that Bath & Body Works will “sell a 49% stake in its China business to Hong Kong-based lingerie maker Regina Miracle International Ltd 2199.HK for $45 million in cash, aiming to boost sales with the help of a local partner..”

As stated, the open interest as of today’s open is greater than the size of the order, and as can be seen, it appears the inclement volume transpired just yesterday, January 24th, 2022.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

To view more information about BBWI's daily flow breakdown, click here to visit unusualwhales.com.

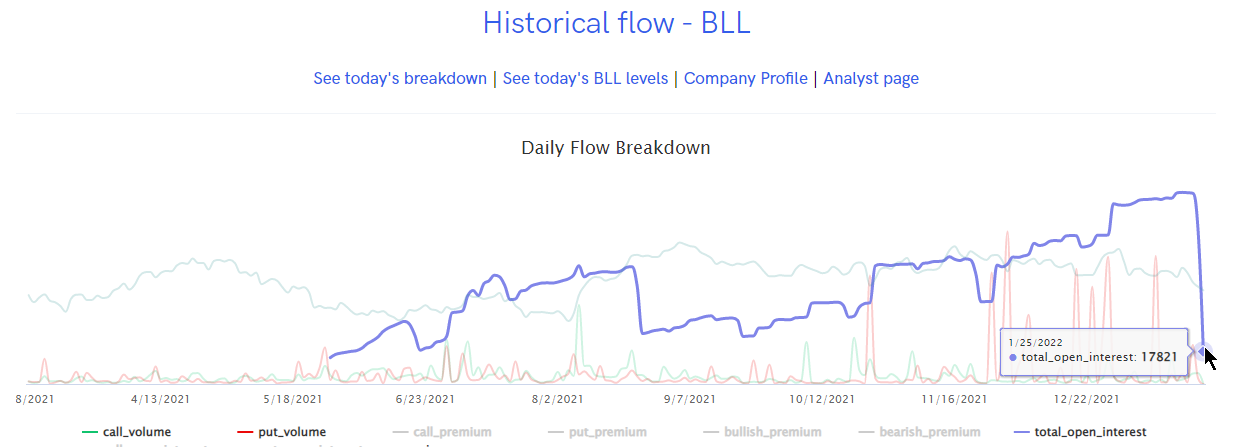

Unusual Options Activity in Ball Corporation (BLL)

Again in the NYSE, we saw unusual activity in Ball Corporation (BLL), which opened today at $86.03.

The following orders came in together asymmetrically dated for February 18th, 2022:

- 3,000 contracts on the $87.5 strike put options, sold to close at the bid at a spot of $4.85 with a bid-ask range of $4.70 to $5.10.

- 4,500 contracts on the $82.5 strike puts options bought to open at the ask at a spot of $2.50 with a bid-ask range of $2.10 to $2.50.

Altogether, it would appear this trader has realized profits on the $87.5 strike put options and has opened a new position on the $82.5 put options.

These orders come before Ball Corporation reports its earnings January 27th, before the market opens.

On January 11th, 2022 this trader entered into the approximate 3,000 contracts somewhere at the bid-ask of $1.85 to $2.18, and today they have taken profits, as speculated in the above, realizing approximately $3.00 of profit on each contract.

Furthermore, as stated, this trader has seemingly opened novel volume in the amount of 4,500 contracts but at the $82.5 strike.

To view more information about BLL's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Citigroup Inc. (C)

Finally, and once again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Citigroup Inc. (C), which opened today at $61.97.

The following orders came in together asymmetrically for the $67.5 strike call options dated for April 14th, 2022:

- Two sets of 10,000 contracts bought to open at the ask at a spot of $1.59 in one order and $1.60 in another with a bid-ask range of approximately $1.56 to $1.60. It appears the first set of 10,000 was canceled and came back a few moments later.

- 20,000 contracts bought to open at the ask at a spot of $1.63 with a bid-ask range of approximately $1.61 to $1.65.

Citigroup goes ex-dividend on February 4th, 2022.

A tip from the flow: Beware of ex-dividend dates! You might want to avoid trading calls surrounding a stock's ex-dividend date, even if the options order flow shows a lot of call volume:

You might be seeing traders that are looking to capture as much of the dividend as possible, who are looking to exercise deep ITM call options.

Please note, trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market.

Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

67% of the premium traded at these premium levels are in bullish bets, with 74% as ask-side orders, and 92.2% are in call premiums.

To view more information about C's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.