Unusual Options Activity in Blue Owl Capital Inc. (OWL), Invesco Mortgage Capital Inc. (IVR), and NVIDIA Corporation (NVDA)

Unusual Options Activity in Blue Owl Capital Inc. (OWL)

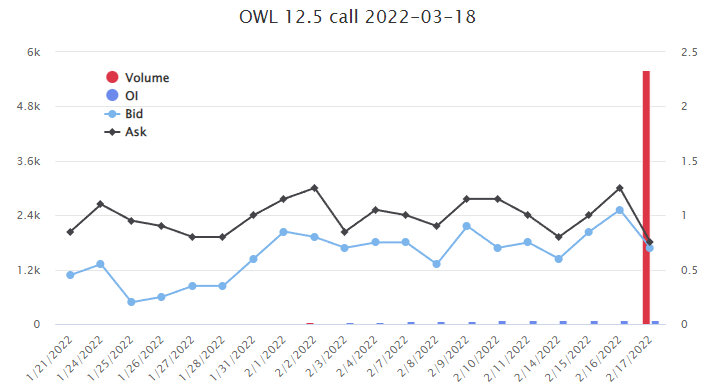

Today, February 17, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Blue Owl Capital, which opened at $13.09.

- There were a plethora of contracts swept-to-fill and traded on the $12.5 strike call option contract dated for March 18th, 2022 bought to open close to the ask at a spot price of $0.80 with a bid-ask range of $0.75 to $0.80.

- Please note, Blue Owl Capital reported its earnings this morning, February 17th, 2022:

GAAP net income attributable to Blue Owl Capital Inc. was $82 thousand, or $0.00 per basic and a net loss of $0.01 per diluted Class A Share, for the quarter ended December 31, 2021.

Additionally, these orders were spotted in the new Unusual Whales hottest chains page with a high acceleration factor; this implied that more orders outside of a standard deviation were being opened on this chain.

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

- These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

- Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

As stated, the volume on this chain is surpassing its open interest. Read this Twitter thread to learn more about why this is significant.

To view more information about OWL's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Invesco Mortgage Capital Inc. (IVR)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Invesco Mortgage Capital Inc. (IVR), which opened today at $2.53.

- There were a series of trades on the $2.5 strike put option dated for February 25th, 2022, bought to open at the ask of $0.12 with a bid-ask range of $0.02 to $0.13. Please note how illiquid this chain is given this spread.

- Please note, Invesco Mortgage Capital reporting its earnings today, February 17th, 2022, after market close.

As with the previously reported activity, these orders were spotted in the new Unusual Whales hottest chains page with a high acceleration factor.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

- Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

- Be mindful! Trades without the briefcase emoji might still have been bought or sold to open! You may also watch this video to see how to track these kinds of opportunities in the Unusual Whales flow.

- Furthermore, just because these orders were indeed opened, it cannot be absolutely known whether these calls were sold to open or bought to open.

Please note, there are no premium levels greater than the $1,000 range, as this company’s market capitalization is approximately $773M and its options chains illiquid.

70.4% of the premium traded at these premium levels are in bearish bets, with 64.4% as ask-side orders, and 94% are in put premiums.

To view more information about IVR's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in NVIDIA Corporation (NVDA)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in NVIDIA Corporation (NVDA), which opened today at $256.30.

- There were 1,219 contracts traded on the $150 strike put option for March 18th, 2022, bought to open at the ask of $0.29 with a bid-ask spread of $0.28 to $0.30. The open interest on this

- Additionally, there were another 1,219 contracts on the same strike, but for February 18th, 2022, sold to close, intuited as the open interest on this chain was approximately 3K as of this morning, and that expiration is tomorrow.

- If these orders were together, it could have been a part of a calendar spread now being closed; alternatively, this trader could be rolling their February expiration to March. The only way to determine that would be to look at the open interest on the March chain tomorrow to see if it increases or decreases by approximately a thousand in kind. Read this Twitter thread on how to identify a roll.

- Please note, NVIDIA reported its earnings yesterday, February 16th, 2022:

GAAP earnings per diluted share for the quarter were a record $1.18, up 103 percent from a year ago and up 22 percent from the previous quarter. Non-GAAP earnings per diluted share were $1.32, up 69 percent from a year ago and up 13 percent from the previous quarter.

The aforementioned orders of the $250 strike put options are the most voluminously traded now, given the expiration and the post-earnings dates. As always, volume does not imply directionality and sometimes can obscure sentiment altogether.

To view more information about NVDA's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.