Unusual Options Activity in Caesars Entertainment, Inc. (CZR), MGM Resorts International (MGM), and Kohl's Corporation (KSS)

Unusual Options Activity in Caesars Entertainment, Inc. (CZR), MGM Resorts International (MGM), and Kohl's Corporation (KSS).

Unusual Options Activity in Caesars Entertainment, Inc. (CZR)

Today, within the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Caesars Entertainment, Inc. (CZR), which opened at $118.72.

There were 3,367 contracts traded on the $135 strike call option, sold at the bid, for approximately $1,200,000 premium, representing approximately 336,700 shares.

These orders come after reports stating that insiders sold US$4.4m worth of stock suggesting impending weakness.

On September 27th, 2021, CZR had a high of 75,323 call volume; bullish volume has descended today and it is likely in no small part to the whale selling the above calls.

To view more information about CZR's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in MGM Resorts International (MGM)

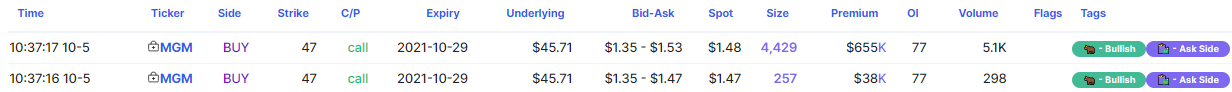

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in MGM Resorts International, which opened today at $44.66.

There were 4,429 contracts traded on the $47 strike call option at the ask, dated for October 29th, 2021, representing approximately 442,900 shares.

These orders come after our first reports on unusual options activity in MGM Resorts International.

As of this writing, MGM has had 19,394 calls traded, which is down from October 1sts unusual activity of 35,671 traded, but appears to be a continuation of the trend of bullish betting and sizing on MGM.

To view more information about MGM's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Kohl's Corporation (KSS)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Kohl's Corporation (KSS), which opened at $49.18.

The unusual activity reported below comes after our first reports on Kohl’s Corporation, where KSS’s price target was increased to $75 by Bank of America and given a buy rating.

There were 5,000 contracts traded on the $65 strike call option at the bid, dated for November 19th, 2021, representing approximately 500,000 shares.

These orders come after reports explaining supply chain issues are what Hutchinson said "could hinder Kohl's sales recovery."

As seen, bullish premium still accounts for 86.3% of the options chains, yet the flow of premiums above $10,000 or more remain 81.16% bullish, in spite of the above calls sold at the bid, representing $120,000 of premium traded.

To view more information about KSS's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.