Unusual Options Activity in Delta Air Lines, Inc. (DAL), Endo International plc (ENDP), and Luminar Technologies, Inc. (LAZR)

Unusual Options Activity in Delta Air Lines, Inc. (DAL)

Today, January 24, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Delta Air Lines, which opened at $36.95.

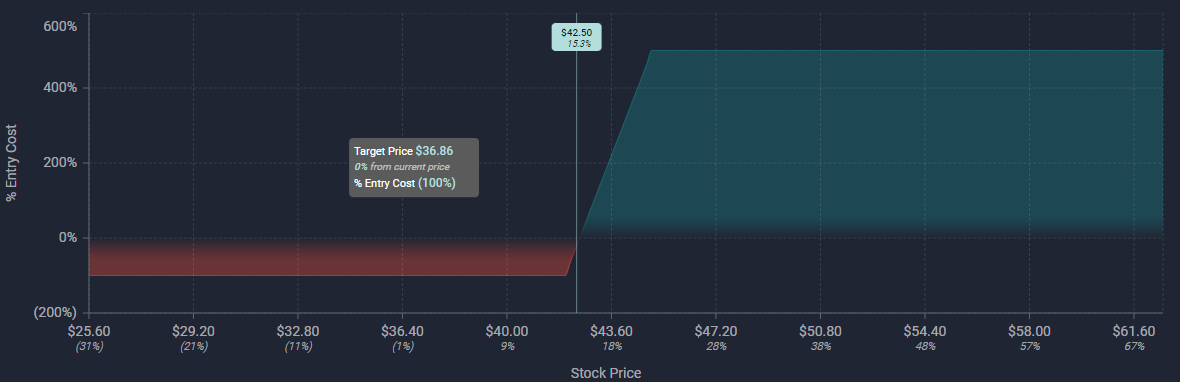

The following orders came in together as 18,000 contracts traded, dated for April 14th, 2022:

- $42 strike call options bought to open at the ask at a spot of $1.18 with a bid-ask range of $1.32 to $1.18.

- $45 strike call options traded at the bid at a spot of $.62 with a bid-ask range of $0.62 to $0.67. The size and volume of these orders have not surpassed the open interest on the chain, which was already approximately 21,000; therefore, it cannot be absolutely known whether the $45 strike calls here were opened or closed.

Altogether, assuming this strategy was opened together, this represents a bullish call debit spread.

These orders come just after reports from Maharathi Basu from Zacks reported that: “On the earnings front, Delta kicked off the fourth-quarter 2021 earnings season for the airline stocks on a bright note. DAL reported better-than-expected earnings per share and revenues for the same period..”

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

To view more information about DAL's daily flow breakdown, click here to visit unusualwhales.com.

image below

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Endo International (ENDP), which opened today at $3.16.

The following orders came in together first as 5,000 contracts traded, then were canceled (denoted by the struck out orders in the image below) and replaced with 4,000 contracts, all dated for April 14th, 2022:

- $3 strike calls sold to open at the bid.

- $3 strike puts sold to open at the bid.

Please note, trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market.

Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

This is not the first time we have reported on unusual options activity in Endo International.

These orders come after Manas Mishra from Reuters reported Endo International had agreed to pay up to $65 million to resolve claims by the state of Florida and local governments that the drugmaker helped fuel the U.S. opioid epidemic.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Be mindful! Trades without the briefcase emoji might still have been bought or sold to open! You may also watch this video to see how to track these kinds of opportunities in the Unusual Whales flow.

Furthermore, just because these orders were indeed opened, it cannot be absolutely known whether these calls were sold to open or bought to open; however, they were traded at and in some cases above the ask, so assuming long, bought-to-open positions is often what intuition tells us.

35.74% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, the $5,000 premium levels are in bearish premiums at 66.97%, still with over $1M in premium traded in calls.

To view more information about ENDP's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Luminar Technologies, Inc. (LAZR)

Finally, and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Luminar Technologies, Inc. (LAZR), which opened today at $12.57.

The following orders came in together as 1,988 contracts traded:

- $12.5 strike call options dated for February 18th, 2022, bought to open at the ask at a spot of $1.08 with a bid-ask range of $1.06 to $1.08.

- $14 strike call options sold to open at the bid dated for February 4th, 2022, at a spot of $0.33 with a bid-ask range of $0.32 to $0.36.

Altogether, this strategy represents a diagonal call spread. We can know this was not a roll (as we have reported on previously) because there was insufficient open interest on the February 4th chain to have sold to close and then bought to open on the 18th.

As these orders come just ahead of Luminar being expected to announce their arounds on or around February 10th, 2022, it is no surprise to see calendar or diagonal spreads being traded.

Some strategies such as these take advantage of volatility. A diagonal spread is just the same as a calendar spread, but instead of the same strikes across two different dates, the strikes are different, as well.

- IV increases more and more as an event date such as an earnings report approaches. It rapidly declines after the event passes.

- This is known as "IV crush"--as options' prices would be significantly higher as IV was increased due to the catalyst, and their prices would fall down after the event passed.

- This is why trading around earning dates is so difficult, as earnings both have enormous amounts of trades around them and expectations of the profits of the company. Once the selling transpires after the ER is released, IV rapidly decreases as the catalyst is now "known" to the market and therefore options' pricings also decline.

As can be seen, the open interest is not high enough for the February 4th contracts to have been closed, so therefore we may interpret these as having been bought or sold to open, as well.

To view more information about LAZR's flow breakdown, click here to visit unusualwhales.com.