Unusual Options Activity in Marqeta, Inc. (MQ), Farfetch Limited (FTCH), and Vinco Ventures, Inc. (BBIG)

Unusual Options Activity in Marqeta, Inc. (MQ)

Today, January 18, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Marqeta, which opened at $13.12.

- There were 12,500 contracts traded on the $12.5 strike put option, bought to open at the ask, dated for February 18th, 2022.

This is not the first time we have reported on unusual options activity in Marqeta.

These orders come after Eric Volkman from The Motley Fool explained that a series of analysts had slashed Marqeta’s price targets, albeit at least one maintained a buy rating.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

On the Unusual Whales blog is a report on floor traders' performance. Here is a snippet:

“More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.”

As can be seen, the volume on this chain overshadows the open interest (which is hardly viewable given the scale of these orders), so therefore we know these contracts were, indeed, bought or sold to open, not closed.

To view more information about MQ's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Farfetch Limited (FTCH)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Farfetch Limited (FTCH), which opened today at $26.11.

- There were 9,750 contracts traded on the $35 strike call option, bought to open at the ask, dated for April 14th, 2022.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Trades without the briefcase emoji might still have been bought or sold to open! You may also watch this video to see how to track these kinds of opportunities in the Unusual Whales flow.

Be mindful! Just because these orders were indeed opened, it cannot be absolutely known whether these calls were sold to open or bought to open; however, they were traded at and in some cases above the ask, so assuming long, bought to open positions is often what intuition tells us.

Of interest, these orders were marked as a “sweep”. Options sweeps are market orders that are split into various sizes to take advantage of the best prices across all exchanges. Sweeps indicate a trader felt taking the position was time-sensitive, so they were willing to be filled at the best prices available, even in spite of potentially better forthcoming prices. However, sweeps do not indicate a direction nor do they unveil a trader’s agenda, such as entering into other legs of a strategy or rolling contracts.

Seen above, the put/call ratio in Farfetch is .021, which is decisively bullish. Furthermore, 72.89% of the premium traded thus far today is in bullish bets.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish.

Furthermore, the bullish sentiment on Farfetch is propagated by an RSI alert from BNK Invest:

“A bullish investor could look at FTCH's 29.6 RSI reading today as a sign that the recent heavy selling is in the process of exhausting itself, and begin to look for entry point opportunities on the buy side..”

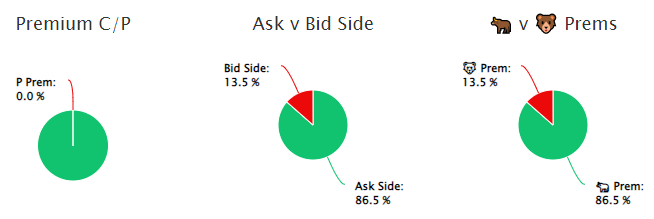

86.5% of the premium traded at these premium levels are in bullish bets, with 86.5% as ask-side orders, and 100% are in call premiums.

To view more information about FTCH's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Vinco Ventures, Inc. (BBIG)

Finally, in the Nasdaq Capital Market (NasdaqCM), we saw unusual or noteworthy options trading volume and activity in Vinco Ventures, Inc. (BBIG), which opened today at $4.76.

- There were a series of orders on the $6 strike call option, dated for January 28th, 2022.

- Of note, the volume on this chain has not yet surpassed its open interest, and no orders were outright greater than the open interest by size, so it cannot be ascertained as to whether these orders are opened or closed.

These orders come after Louis Navellier of InvestorPlace speculated that:

“Vinco Ventures Could Rebound with Company’s TikTok-Like App”.

As seen, the volume from Friday, the 14th, was well above the open interest. However, today’s open interest only increased by approximately 2,000 from Friday, in spite of the 10,663 volume.

Today, there has been 8,157 volume thus far, so we can intuit that at least some of these contracts are to open, but could have been sold to open, potentially as part of a spread (click here to read more about those possibilities).

Furthermore, the open interest tomorrow could not increase as much, as we saw from Friday into today, revealing traders are not holding these contracts overnight.

To view more information about BBIG's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.