Unusual Options Activity in Mattermark (MTTR), Hilton. (HLT), and Ovintiv Inc (OVV)

A Review of Unusual Options Activity in MTTR

Today, March 29, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options activity in Service Properties:

- Incredible amounts of new volume when on the MTTR 10 C calls for 4/14/2022. We will need to see if the OI sustains tomorrow.

OVV and HLT:

With OVV we can see numerous put selling occurring on a day it has performed terribly (down 4% at time of writing.)

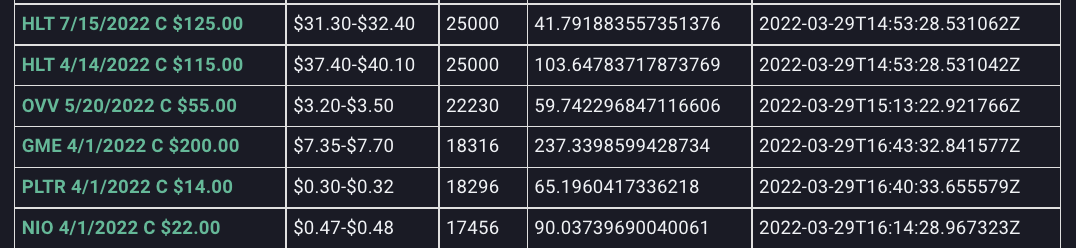

Beyond this put selling, (purple where size is greater than current OI, thus opening positions), we can see both OVV and HLT take up top spots in the most unusual trading positions for mid-cap companies (as defined by https://unusualwhales.com/flow/dashboard).

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish.

To view more information about OVV's daily flow breakdown, click here to visit unusualwhales.com.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

To view more information about HLT's flow breakdown, click here to visit unusualwhales.com.