Unusual Options Activity in Palantir Technologies Inc. (PLTR), Freeport-McMoRan Inc. (FCX), and Pinduoduo Inc. (PDD)

Unusual Options Activity in Palantir Technologies Inc. (PLTR)

Today, January 28, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Palantir, which opened at $12.30.

The following orders came in together asymmetrically, both dated for February 4th, 2022:

- $12 strike put options bought to open at the ask at a spot price of $0.59 with a bid-ask range of $0.58 to $0.60. The size and volume on this chain has overtaken its open interest as of this order.

- $13.5 strike put options traded at the bid at a spot price of $1.50 with a bid-ask range of $1.49 to $1.60.

- Of note, the volume on the $13.5 chain has been approximately 6,000 contracts thus far today, which is not enough to overtake its open interest of approximately 7,000, so it cannot be known whether these contracts were opened or closed.

We may speculate, however, given the size and nature of these orders having come in together, that the $13.5 strike put options are being closed and rolled down to the $12 strike put options, but in greater volume.

These orders come just after Adam Spatacco of The Motley Fool begged the question: “Is Palantir the AWS of Data Analytics?”

All orders thus far this morning have been ask-side orders, with the unusual volume reported here overtaking the chart completely.

Today’s volume has now overtaken open interest, so we can be rest assured that these orders were in fact to open, not to close; however, it cannot be known whether these orders will closed before the end of the day or not, and open interest at Monday’s open will have to be reviewed to know if these traders remained in these positions or not.

We may compare the $12 strike chain’s volumes and open interests to the $13.5 chain; it becomes evident that as the volume, in red, has not overtaken the open interest, in blue, that these orders could have been to open or to close, but again, as mentioned, as both of these came in together, we may intuit them as having closed the $13.5 strike put options to open the $12 strike put options, but this cannot be verified until Monday morning.

Finally, of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag. Click here to read about floor traders' performance.

To view more information about PLTR's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Freeport-McMoRan Inc. (FCX)

Again in the NYSE, we saw unusual activity in Freeport-McMoRan Inc. (FCX), which opened today at $38.41.

There have been a series of orders on a variety of strikes and dates this morning, all sized above the open interest, all markedly out of the money call options, aside from one out of the money put option in a small sized order:

Of significance, the 3,900 $38 strike call options dated for May 20th, 2022 came with a paired $45 strike call option, for the same date, however it was traded at the bid.

If this trader was not rolling their call to another strike, as analyzed in the Palantir trades explained above, these two trades could be interpreted as a bullish call debit spread.

Furthermore, these orders come after its Q4 earnings report: “Freeport-McMoRan Inc.’s FCX shares fell 3% after the company reported fourth-quarter 2021 earnings of $0.96 per share, lagging the Zacks Consensus Estimate of $0.97 per share.”

63.94% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, the $5,000 premium levels are in bullish premiums at 60.47% again with more call premium traded than put premium. As can be seen, the overall options order flow on Freeport-McMoRan is bullish.

To view more information about FCX's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Pinduoduo Inc. (PDD)

Finally, within the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw noteworthy options trading activity in Pinduoduo Inc. (PDD), which opened today at $51.00.

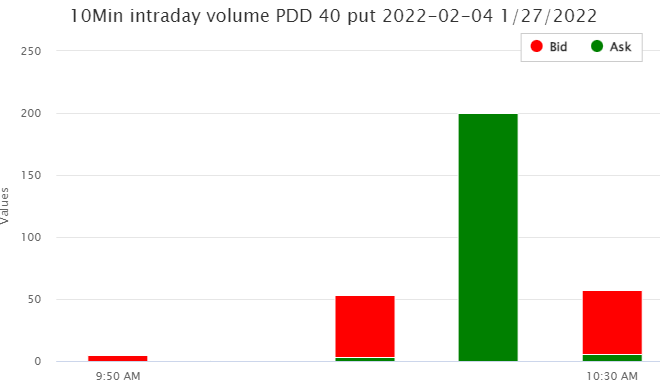

- There were contracts traded on the $40 strike put options dated for February 4th, 2022.

- These contracts were swept at a spot price of $0.28 with a bid-ask range of $0.24 to $0.28.

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

Additionally, these orders come after BNK Invest reported Pinduoduo, experience inflows held within “the iShares MSCI China ETF (Symbol: MCHI) where we have detected an approximate $241.4 million dollar inflow -- that's a 4.1% increase week over week in outstanding units (from 93,600,000 to 97,400,000).”

The orders as the sweeps were coming through were almost entirely ask-side, with bid-side orders transacting around them. This chart on the Unusual Whales flow can be observed throughout the day to speculate upon intraday whale movements.

To view more information about PDD's flow breakdown, click here to visit unusualwhales.com.

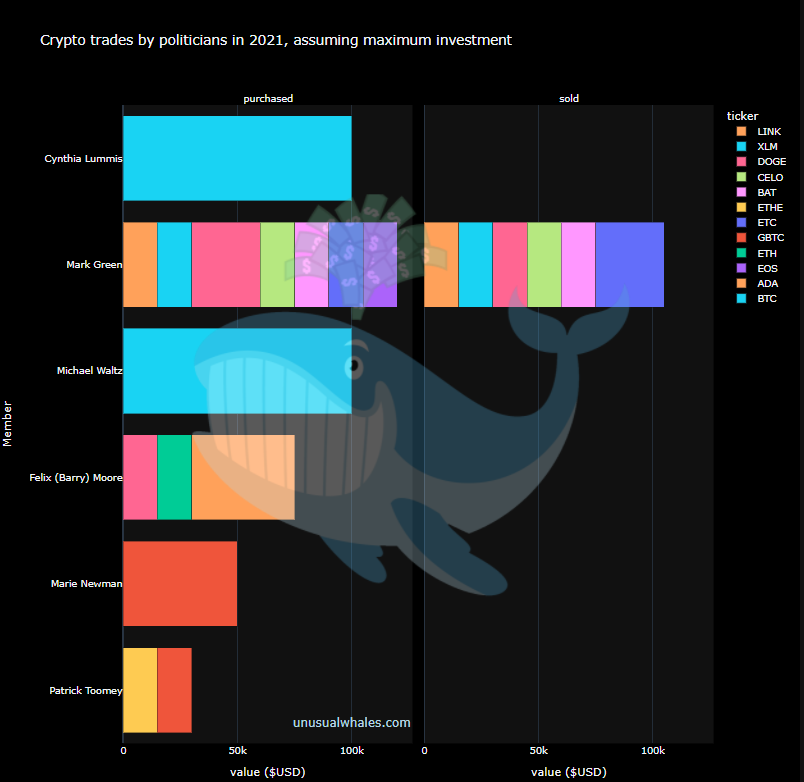

Have you read the Congress and Crypto in 2021 Report yet?

In 2021, members of Congress started accumulating crypto in their personal portfolios, and introduced more bills than ever focusing on crypto policy, 35 of them to be exact.

In 2021, Congress traded:

- $290,000,000 in stocks

- $140,000,000 in options

- $124,000,000 in other securities (PE funds and crypto)

While not overwhelmingly backed by Congress, there is valid and legitimate support from members hinting that future support for cryptocurrency is on the way. Though these members directly involved in crypto only total six, 29 total members have participated in trades involving cryptocurrency or cryptocurrency related companies, suggesting support for pro-crypto legislation might be higher in 2022.

Click here to read the full report for all of the details.

And for more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.