Unusual Options Activity in Tesla, Inc. (TSLA), 3M Company (MMM), and Energy Transfer LP (ET)

Unusual Options Activity in Tesla, Inc. (TSLA)

Today, January 26, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Tesla, which opened at $952.43.

The following orders on the $1025 strike call option came in separately in order sizes of 50 contracts at a time (except the final one of 47), dated for April 14th, 2022, traded at the spots of $92.00 and $94.00 bid-ask ranges of $91.45 to $92.00 and of $93.75 to $94.00, respectively:

Please note, after market close today, Tesla reports its Q4 earnings.

On January 21st, 2022, this same chain had inclement volume, and was traded at or around a spot price of $97.53 with a bid-ask spread of $927.20 to $97.85 (approximations). The open interest remained into today, and now there is more volume on this chain.

To view more information about TSLA's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in 3M Company (MMM)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in 3M Company (MMM), which opened today at $174.28.

There were 4,472 contracts sold to open on the $180 strike call option dated for March 18th, 2022 at a spot price of $1.92 with a bid-ask spread of $1.73 to $2.28. Please note, given the wide bid-ask spread on this chain, it cannot be immediately apparent whether these contracts were indeed sold or bought to open.

These orders come after 3M Company reported its earnings yesterday, January 25th.

However, as seen, these orders had a greater size at 4,472 than the chain’s open interest of 299. So while it cannot be clearly stated these were bought or sold to open, it is the case they were opened, as no existing open contracts were available to close in this order.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Be mindful! Trades without the briefcase emoji might still have been bought or sold to open! You may also watch this video to see how to track these kinds of opportunities in the Unusual Whales flow.

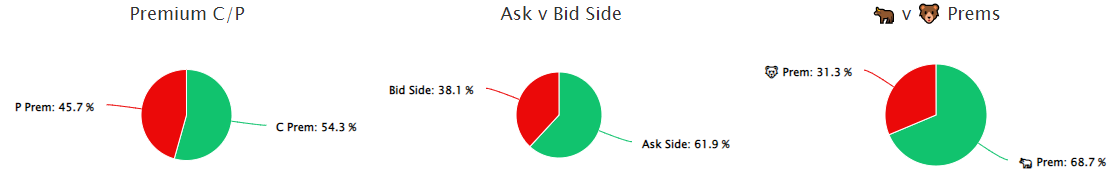

20.04% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, the $5,000 premium levels are in bullish premiums at 22.694%, with an approximately equal amount of premium traded. As can be seen, the overall options order flow on 3M Company is bearish.

To view more information about MMM's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Energy Transfer LP (ET)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Energy Transfer LP (ET), which opened today at $9.76.

Please be aware, an initial set of contracts were dated for February 18th, 2022, for the $10.5 strike call options, but these were canceled; then the following orders came in together as cross trades, sized as 15,000 contracts, dated for February 4th, 2022, instead:

- $10 strike call options bought to open at the ask at a spot of $0.12 with a bid-ask spread of $0.11 to $0.12.

- $10.5 strike call options sold to open at the bid at a spot of $0.04 with a bid-ask spread of $0.04 to $0.05.

As stated, the orders in this report were cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

These orders come just after Scott DiSavino from Reuters reported that “Energy Transfer to supply gas to Texas power plants in Feb freeze dispute”.

Please note, trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market.

Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

The aforementioned orders of the $10 and $10.5 strike call options dated for February 4th, 2022 are significantly higher than any other options chain being traded right now.

To view more information about ET's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.