Unusual Options Activity in Triterras, Inc. (TRIT) and Aurinia Pharmaceuticals, Inc. (AUPH)

On October 28th, we observed unusual options activity for block chain enabled trading finance platform, Triterras, Inc. (NASDAQ:TRIT), which opened the 10/29/2021 trading session at $7.31; $0.80 lower than yesterday’s close of $8.11.

Observed in the Unusual Whales flow tool, 1,447 contracts of the $7.5 call strike expiring November 19th, 2021, May of 2022, and January of 2022. There were also 1,092 contracts of the $5 strike traded, namely for the November 19, 2021 expiration date.

This comes after an astounding run for the stock (based out of Singapore. After today’s morning session pullback, TRIT is still up 22% in the last 5 days. What makes this flow so notable is the comparison of call and put volume on October 28th versus the average volume of options for the stock.

Pictured above, we notice that TRIT rarely has options flow volume above 3,000 total daily contracts traded. On October 25th, this trend was broken in a big way with 19,050 call contract volume. Then, on October 28th (the subject of this short article), we saw a call volume of 63,248 total contracts traded; over 2,600% the previous week’s average of 2392.2.

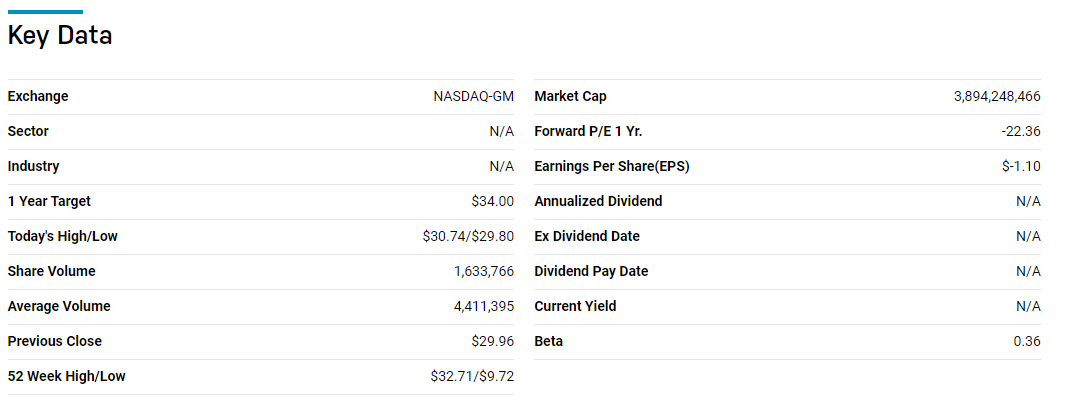

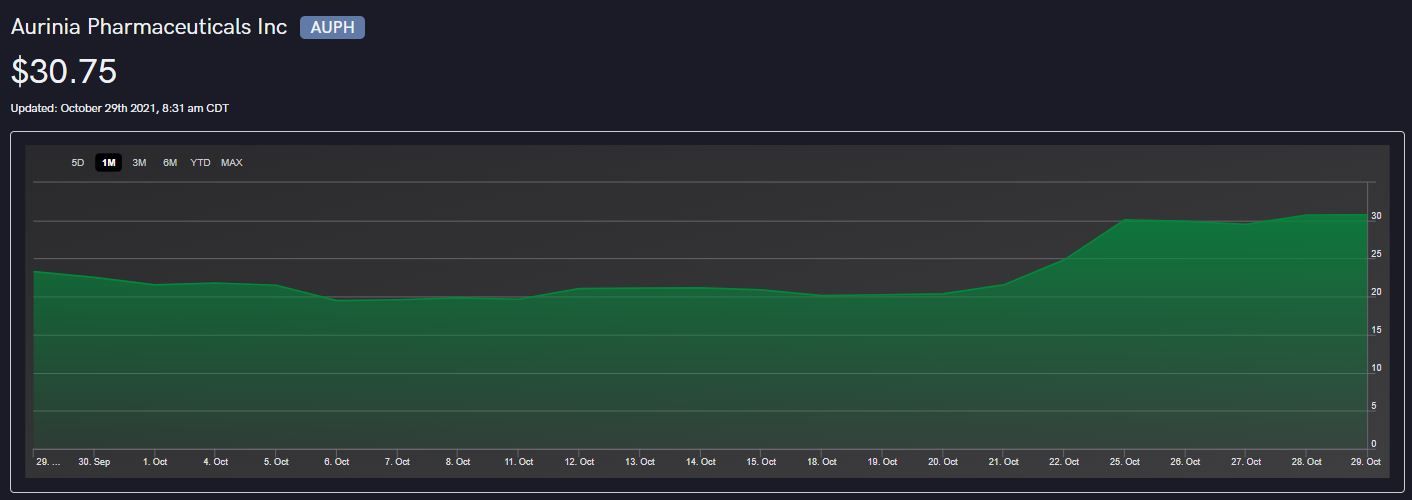

Canadian pharmaceutical company, Aurinia Pharmaceuticals Inc. (NASDAQ:AUPH) also displayed unusual options activity, caught by the Unusual Whales flow tool. The $30 call for November 19, 2021 was the main target of traders, with 1,448 total contracts purchased for a total of $630k in premium.

According to Nasdaq, AUPH, which closed the October 28th trading session at $29.96 per share, has an average analyst price target of $34. Early this year, Aurinia brought to market a new Lupus treatment drug (Lupkynis) after receiving FDA approval in January. The company expects a net revenue from the drug of US$40-50 million this year.