Unusual Options Activity in JPMorgan Chase & Co. (JPM), Energy Transfer LP (ET), and Visa Inc. (V)

Unusual Options Activity in JPMorgan Chase & Co. (JPM)

Today, January 04, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in JPMorgan Chase & Co., which opened at $164.31.

- There were a series of orders at 1,200, 1,800, and 2,976 contracts traded on the $177.5 and $167.5 strike call option contracts, dated for January 21st and 7th, 2022. All of these contracts were traded at the bid.

- JPMorgan Chase & Co. goes ex-dividend tomorrow, January 5th, 2022.

These orders come after Bradley Guichard of TipRanks reported: “JPMorgan has grown its dividend for 13 straight years. It now stands at $1.00 per quarter and yields around 2.4%. The payout ratio is very low, at 23.4%, making the dividend extremely safe. The dividend was last raised in Q3 2021.”

A tip from the flow: Beware of ex-dividend dates! You might want to avoid trading calls surrounding a stock's ex-dividend date, even if the options order flow shows a lot of call volume: You might be seeing market makers that are looking to capture as much of the dividend as possible, who are looking to exercise deep ITM call options.

63.4% of the premium traded at these premium levels are in bullish bets, with 61.7% as ask-side orders, and 94.3% are in call premiums.

To view more information about JPM's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Energy Transfer LP (ET)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Energy Transfer LP (ET), which opened today at $8.80.

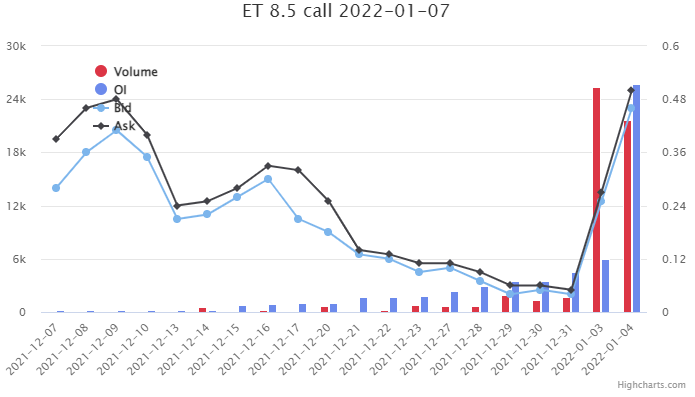

- Yesterday, we reported on there being 17,000 contracts traded on the $8.5 strike call option dated for January 7th, 2021, bought to open at the ask of $0.18 with a bid-ask of $0.16 - $0.18.

- Today, we saw the below orders, 10,200 contracts of the $8.5 strike call option for the 7th being traded at the bid.

- Additionally, we saw 17,000 additional contracts being traded on the $9 strike call option, for the same date, at the ask. Furthermore, the size of this particular set of contracts was greater than the open interest on the chain, which was approximately 5,400 as of this morning’s open, implying the $9 strike calls were opened today.

A tip from the flow: Trades appended with 🛍️ can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the 🛍️ symbol).

Be mindful! Trades without the 🛍️ symbol might still have been bought or sold to open!

These orders come after reports revealing that Energy Transfer “must pay Williams $410 mln for abandoning $33 bln merger.”

The volume yesterday was greater than today’s, however with the size of the reported trades on the $8.5 chain above, it is likely to come close, implying that these contracts are being sold to close today.

Additionally, the open interest can be seen as having risen to slightly above yesterday’s volume, proving the reported contracts from yesterday were, in fact, bought to open.

To view more information about ET's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Visa Inc. (V)

Finally and again, in the NYSE, we saw unusual or noteworthy options trading volume and activity in Visa Inc. (V), which opened today at $222.00.

- There were 3,600 contracts traded on the $245 strike call option dated for March 18th, 2022.

- There were an additional 3,600 contracts bought to open on the $225 strike call option dated for January 21st, 2022.

Be mindful! These orders were cross trades. A cross trade occurs when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken, on both the buy and the sell side.

These orders come after Jennifer Saibil of The Motley Fool explaiend: “Why Visa Stock Gained 12% in December”

81.79% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, even the $5,000 premium levels are in bullish premiums at 73.04%, with over $10,000,000 in premium traded.

To view more information about V's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.