Unusual Options Activity in Kimco Realty Corporation (KIM), KAR Auction Services, Inc. (KAR), and International Business Machines Corporation (IBM)

A Review of Unusual Options Activity in Kimco Realty Corporation (KIM)

Today, February 25, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Kimco, which opened at $23.93.

- There were 2,499 contracts traded on the $25 strike call option dated for March 18th, 2022, bought to open at the ask of $0.25 with a bid-ask spread of $0.20 to $0.25.

- The volume on this chain is now 6,258 contracts traded and had an open interest of only 479 contracts, which implies these orders are being bought or sold to open not to close.

- Be mindful, these orders come prior to Kimco going ex-dividend on March 9th, 2022.

A tip from the flow: Beware of ex-dividend dates! You might want to avoid trading calls surrounding a stock's ex-dividend date, even if the options order flow shows a lot of call volume: You might be seeing traders that are looking to capture as much of the dividend as possible, who are looking to exercise deep ITM call options.

As of this writing, Kimco has had 6,230 calls traded, which is 4,181% greater than its 30-day call average.

To view more information about KIM's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in KAR Auction Services, Inc. (KAR)

Today, February 25, 2022, again in the NYSE, we saw unusual activity in KAR Auction Services, Inc. (KAR), which opened today at $22.05.

- There was a series of orders on the $12.5 strike puts, $25 strike calls, $15 strike calls, all dated for July 15th, 2022.

- Additionally, there was another order on the $20 strike puts, dated for March 18th, 2022.

- Furthermore, these orders come after reports that

“Carvana ($CVNA), the industry pioneer for buying and selling cars online, has signed a definitive agreement to acquire ADESA’s US physical auction business (“ADESA U.S.”), a wholly owned subsidiary of KAR Global ($KAR), subject to customary closing conditions, for $2.2 billion in cash”.

A tip from the flow: The ⚠️emoji means the size of the order was greater than the open interest on the chain itself.

These options were detected using the NEW Unusual Whales tickers flow tool. As can be seen, calls are now 2,293.25% greater and puts are 6,583.48% greater than their respective 30 day volume averages.

To view more information about KAR's flow breakdown, click here to visit unusualwhales.com.

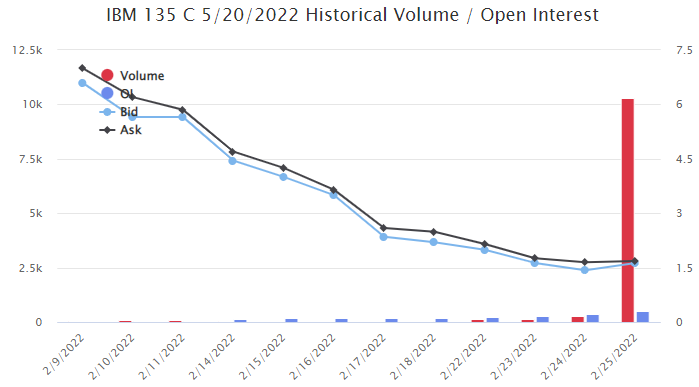

Unusual Options Activity in International Business Machines Corporation (IBM)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in International Business Machines Corporation (IBM), which opened today at $122.05.

- There were 10,000 contracts traded, which were canceled, and then replaced with 9,000 contracts traded on the $135 strike call option dated for May 20th, 2022.

- As these orders were reported late, the bid-ask spread had already adjusted higher to $1.45 to $1.53 from $0.42 to $1.80 as of the 10 o’clock hour. As such, these orders were reported as being traded at $1.36, which would be below the bid at the time of the late order, so it cannot be known whether these were in fact bought or sold at the ask or the bid.

- Please note, trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market. Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

A tip from the flow: Given the sizing of these orders and the open interest on the chain itself of 513, these orders can be intuited as having been bought or sold to open. Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

To view more information about IBM's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.