Unusual Options Activity in Krispy Kreme, Inc. (DNUT), T-Mobile US, Inc. (TMUS), and Coupang, Inc. (CPNG)

Unusual Options Activity in Krispy Kreme, Inc. (DNUT)

Today, February 11, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Krispy Kreme, which opened at $15.11.

- There were 3,000 contracts traded as cross transactions on the $20 strike call option dated for May 20th, 2022, bought to open near the ask at a spot price of $0.60 with a bid-ask spread of $0.45 to $0.70.

- The open interest on this chain was 472 contracts, so therefore the 3,000 volume today implies these contracts were either bought or sold to open, not closed.

- These orders come just ahead of Krispy Kreme reporting its earnings on February 22nd, 2022.

As stated, the orders in this report were cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

The volume on this chain has now increased to 3,001 as of this writing; the open interest today was 472, so we can intuit these contracts all as having been bought or sold to open, not closed.

To view more information about DNUT's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in T-Mobile US, Inc. (TMUS)

Again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in T-Mobile US, Inc. (TMUS), which opened today at $124.69.

- There were three sets of 2,122 contracts traded on the May 20th, 2022 expiration date for the following call options:

- The $150 strike call option traded close to the ask at a spot of $1.38 with a bid-ask spread of $1.11 to $1.44.

- The $130 strike call option traded at the ask of $6.65 with a bid-ask spread of $6.20 to $6.65.

- The $145 strike call option traded at the ask of $2.17 with a bid-ask spread of $1.65 to $2.17.

- All of these chains’ open interests, aside from the $145 strike call, were less than the order sizes of 2,122.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag. Click here to read about floor traders' performance.

A tip from the flow: Trades appended with the ↕ emoji are trades that have potentially came in together as a part of a strategy, and are coded accordingly as MLET or MLFT, under the codes column. Click on that emoji will open all of the trades that came in together so that the holistic strategy may be investigated.

These orders come after Simply Wall St begged the question: “Can T-Mobile US, Inc. Maintain Its Strong Returns?”.

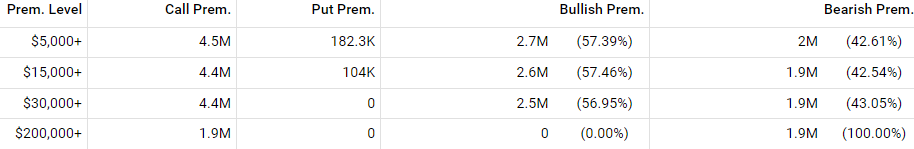

56.95% of the premium traded at the $30,000 levels are in bullish bets, with all betting being in call premiums. Furthermore, the $5,000 premium levels are in bullish premiums at 57.39%, with $4.5M in call premiums versus only $182.3K in put premiums traded. As can be seen, the overall options order flow on T-Mobile is bullish.

To view more information about TMUS's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Coupang, Inc. (CPNG)

Finally, in the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Coupang, Inc. (CPNG), which opened today at $22.78.

- There were 6,055 contracts traded on the $37.5 strike call option dated for May 20th, 2022 near the ask at a spot price of $0.24 with a bid-ask spread of $0.19 to $0.25.

- The open interest on this chain was 8.4K as of today’s open, and the volume is 6.1K as of this order; so, therefore, it cannot be known whether these orders are being closed or opened.

Please note, Coupang reports its earnings today, February 11th, after market close.

53.9% of the premium traded is in bullish bets, with 4.1% of the premium traded is in calls, with 47.8% as ask-side orders. The put call ratio for Coupang is 1.08, which is bearish.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about CPNG's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.