Unusual Options Activity in LendingClub Corporation (LC), Aldeyra Therapeutics, Inc. (ALDX), and Ferroglobe PLC (GSM)

Unusual Options Activity in LendingClub Corporation (LC)

Today, October 27, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in LendingClub Corporation, which opened at $34.79.

There were 2,000 contracts traded on the $34 strike put option, bought to open at the ask, dated for November 19th, 2021.

Additionally, there were another 2,000 contracts traded on the $38 strike call option, sold to open at the bid, for the same date.

Altogether, these contracts represent approximately 400,000 shares and $1,000,000 in premium traded.

These orders come just before LendingClub Corporation reports its earnings after market close today. Furthermore, Mr. Bram Berkowitz from The Motley Fool detailed reasons as to why Lending Club could deliver strong earnings results.

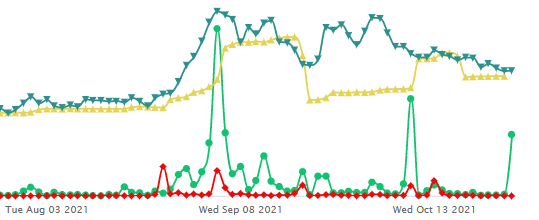

Bearish premium now leads the flow at these levels, with 79% bearish betting, with 50.5% put premium traded, 71.5% at the ask.

To view more information about LC's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Aldeyra Therapeutics, Inc. (ALDX)

Again, in the NYSE, we saw unusual or noteworthy options trading volume and activity today in Aldeyra Therapeutics, Inc. (ALDX), which opened at $24.81.

There were 3,500 contracts traded on the $15 strike option, bought to open at the ask, dated for December 17th, 2021.

Additionally, there were another 3,500 contracts traded on the $10 strike call option, also bought at the ask, for the same date.

Altogether, these contracts represent approximately 700,000 shares and $530,000 in premium traded.

These orders come in after Simply Wall St asked “whether this debt is making the company risky” and noted that:

“And we do note that Aldeyra Therapeutics had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$37m and booked a US$46m accounting loss. Given it only has net cash of US$109.4m, the company may need to raise more capital if it doesn't reach break-even soon.”

As of this writing, ALDX has had 7,649 call volume, which is approximately 955% above its 30-day mean.

To view more information about ALDX's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Ferroglobe PLC (GSM)

Finally, in the Nasdaq Capital Market (NasdaqCM), we saw unusual or noteworthy options trading volume and activity in Ferroglobe PLC (GSM), which opened at $7.02.

There were 7,500 contracts traded on the $8 strike option, bought to open at the ask, dated for December 17th, 2021.

Additionally, there were another 7,500 contracts traded on the $9 strike call option, also bought at the ask, for the same date.

Altogether, these contracts represent approximately 1,500,000 shares and $758,000 in premium traded.

These orders come after continued reports of the EU's power supply crunch pressuring ferro alloy production.

As of this writing, GSM has had 97,604 call volume, which is approximately 4,066% above its 30-day mean.

To view more information about GSM's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.