Unusual Options Activity in Lumen Technologies, Inc. (LUMN), Twitter, Inc. (TWTR), and Microsoft Corporation (MSFT)

Unusual Options Activity in Lumen Technologies, Inc. (LUMN)

Today, February 10, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Lumen, which opened at $11.17.

- The following orders were swept-to-fill on the $10 strike put option dated for February 18th, 2022 at spot prices of $0.07 to $0.10 with a bid-ask spread of $0.07 to $0.08; as noted, some of the latest orders on this chain were bought above the ask.

These orders come after Zacks Equity Research explained “Lumen (LUMN) Q4 Earnings Miss Estimates, Revenues Fall Y/Y”.

As mentioned, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

The volume on this chain has now increased to 11,692 as of this writing; the open interest today was 3,468, so we can intuit these contracts all as having been bought or sold to open, not closed.

To view more information about LUMN's daily flow breakdown, click here to visit unusualwhales.com.

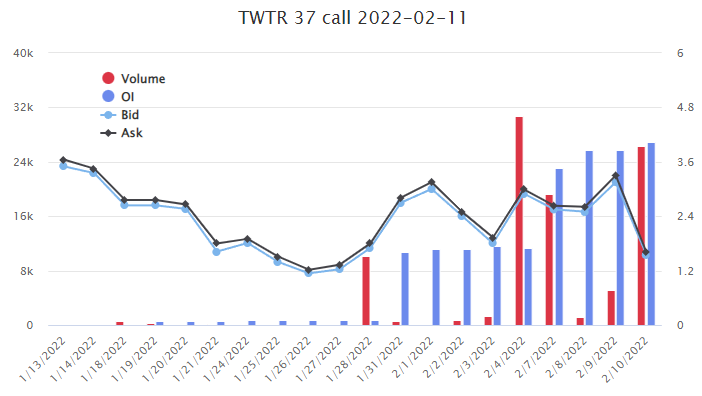

Unusual Options Activity in Twitter, Inc. (TWTR)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Twitter, Inc. (TWTR), which opened today at $36.56.

- There were 20,000 contracts traded on the $37 strike call option dated for February 11th, 2022, close to the ask at a spot of $1.81 with a bid-ask spread of $1.75 to $1.83.

- The volume on this chain is not greater than its open interest, as compared to the previous unusual activity in this report.

- However, these contracts are noteworthy due to the size of the order, and because they are cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

These orders come after Zacks reported Twitter “came out with quarterly earnings of $0.33 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.38 per share a year ago. These figures are adjusted for non-recurring items.”.

As stated, these orders were not greater than the chain’s open interest. Therefore, we might intuit that these contracts are being bought and sold to close, as in traders are looking to exit their orders, especially after they have profited (either by selling short or otherwise) since Twitter’s earnings report.

To view more information about TWTR's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Microsoft Corporation (MSFT)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Microsoft Corporation (MSFT), which opened today at $304.04.

- There have been sizable, noteworthy, and significant orders deeper in the money chains, such as on $325 puts sold to open at the bid, dated for February 18th, 2022.

- Please note, Microsoft goes ex-dividend on February 16th, 2022.

A tip from the flow: Beware of ex-dividend dates! You might want to avoid trading calls surrounding a stock's ex-dividend date, even if the options order flow shows a lot of call volume:

You might be seeing traders that are looking to capture as much of the dividend as possible, who are looking to exercise deep ITM call options.

- Additionally, there were $320 strike and $325 strike put options dated for February 11th, 2022, rolled to February 18th, 2022.

- This is knowable because the size of these orders, 7,382 contracts traded, amounts to nearly the open interest on the February 11th chain of approximately 9,000 contracts; the same sized orders were then placed, but in the inverse (buying to open the $320 strikes and selling to open the $325s), for February 18th, implying the trader is simply moving their strategy to the next week.

To view more information about MSFT's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.