Unusual Options Activity in Marathon Digital Holdings, Inc. (MARA), SM Energy Company (SM), and NIKE, Inc. (NKE)

Unusual Options Activity in Marathon Digital Holdings, Inc. (MARA)

Today, March 15, 2022, in the NasdaqCM, there was unusual or noteworthy options trading activity in Marathon Digital Holdings, Inc. (MARA), which opened at $21.33.

- There were a series of contracts traded on the $25 strike call option contract for May 20th, 2022, bought to open at $3.05 with a bid-ask spread of $2.90 to $3.05.

- The volume on this chain thus far has been 4,508 contracts traded and the open interest was 1,897 as of this morning’s open. Therefore, we may intuit these contracts are being either bought or sold to open, not being closed.

- Additionally, these orders come after Treasury Secretary Janet Yellen said a still-pending executive order on virtual currencies from President Joe Biden "calls for a coordinated and comprehensive approach to digital asset policy (that) will support responsible innovation".

As seen, the contracts had an acceleration factor of 0.94, implying there was a rapid increase in trading activity over open interest on this chain. Furthermore, the red bar in the “OHLC” column is lower than the green, implying the low price was a valid entry and has sold higher than its current price, open contract price, and closing price.

A tip from the flow: The ! emoji means the volume of the chain is greater than the open interest on the chain itself.

The open interest on this chain today was 1,897 contracts and the volume thus far has been 4,508; therefore, these contracts may be intuited as having been to open.

To view more information about MARA's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in SM Energy Company (SM)

In the NYSE, there was unusual or noteworthy options trading activity in SM Energy Company (SM), which opened today at $34.15.

- There were 10,778 contracts bought to open on the $45 strike call options dated for April 14th, 2022.

- The overall volume on this chain has been approximately the aforementioned order size, about 10.9K, and the open interest on the chain is 8.4K; therefore, at least approximately 2K of these contracts were opened, not closed.

- These orders come after Zacks Equity Research explained that the leading upstream energy firm is likely to record earnings growth of 257.8% and 18% in 2022 and 2023, respectively.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

A tip from the flow: When viewing alerts in the Unusual Whales flow, you can click the order’s option contract expiration to open another panel which has three additional charts and a table to take a deeper dive into the company’s overall intraday options volumes, the chain’s bid-ask pressures, and historical volumes and open interests.

There is no way to discern whether these contracts were opened or closed, however, as the open interest on this chain was 8,379 and the volume is 10,996; given the bid-ask spread on this chain has come down to $0.85 to $1.00 from $2.45 to $2.75 from March 10th, 2022.

To view more information about SM's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in NIKE, Inc. (NKE)

Finally in the NYSE, there was unusual or noteworthy options trading activity in NIKE, Inc. (NKE), which opened today at $119.84.

- There were sweeps on the $130 strike call option dated for March 25th, 2022 bought to open above the ask at $1.71 with a bid-ask spread of $1.56 to $1.70.

- Additionally, these orders come before NIKE reports its earnings March 21st, 2022 after market close.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

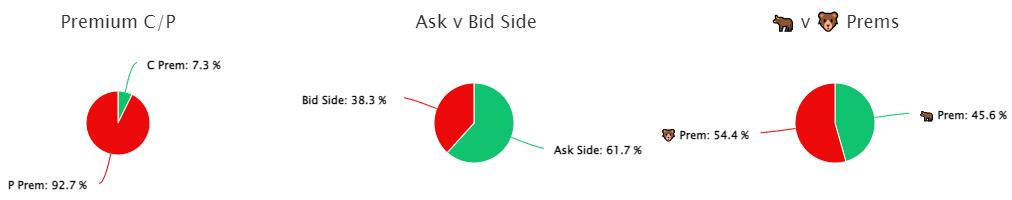

45.6% of the premium traded is in bullish bets, with 7.3% of the premium traded is in calls, with 61.7% as ask-side orders. The put call ratio for NIKE is 1.05, which is bearish.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about NKE's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.