Unusual Options Activity in Mattel, Inc. (MAT), Five9, Inc. (FIVN), and Spectrum Brands Holdings, Inc. (SPB)

Unusual Options Activity in Mattel, Inc. (MAT)

Today, November 08, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Mattel, Inc., which opened at $22.00.

There were 5,000 contracts traded on the $21 strike put option, sold at the bid, dated for November 19th, 2021.

There were an additional 5,000 contracts traded on the $23 strike call option, bought at the ask, dated for November 12th, 2021.

Altogether, these contracts represent approximately 1,000,000 shares and $160,000 in premium traded.

These orders come after reports from BNK Invest which opined: “With USMF trading at a recent price near $41.18 per unit, that means that analysts see 10.09% upside for this ETF looking through to the average analyst targets of the underlying holdings”, one of which includes Mattel, Inc.

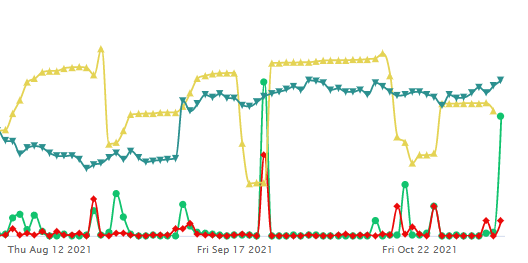

The charts above represent Mattel, Inc.’s historical price in blue, call volume in green, put volume in red, and open interest in yellow. As of this writing, MAT has had 8,327 calls traded, which is 130% greater than its 30-day call average.

To view more information about MAT's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Five9, Inc. (FIVN)

In the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in Five9, Inc. (FIVN), which opened at $149.10.

There were a total of 2,500 contracts traded on the $155 strike call option, sold to open at the bid, dated for December 17th, 2021.

Additionally, there were another 2,500 contracts traded on the $180 strike call option, bought to open at the ask, for the same date.

These contracts represent a put credit spread, approximately 500,000 shares, and $2,100,000 in premium traded.

In addition to the above, it is suspected a series of put orders came through, potentially from the same trader or entity:

These orders come in before Five9, Inc. reports its earnings today, November 8th, 2021, after the market closes.

As seen, bearish premium accounts for 81.1% of the options chains, with 57.4% bid-side orders with calls account for 64.4% of the flow.

To view more information about FIVN's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Spectrum Brands Holdings, Inc. (SPB)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Spectrum Brands Holdings, Inc. (SPB), which opened at $97.23.

There were 750 contracts traded on the $110 strike call option, bought at the ask, dated for November 19th, 2021.

Furthermore, there were additional out of the money contracts traded on the $100 and $95 strike call options, at the ask, as well as the $85 strike put options, again at the ask, all dated for November 19th, 2021.

These orders come before Spectrum Brands Holdings, Inc. reports its earnings today, November 12th, 2021, before the market opens.

As of this writing, SPB has had 6,091 calls traded, which is 3,205% greater than its 30-day call average.

To view more information about SPB's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.