Unusual Options Activity in Micron Technology, Inc. (MU), PagSeguro Digital Ltd. (PAGS), and Bed Bath & Beyond Inc. (BBBY)

Unusual Options Activity in Micron Technology, Inc. (MU)

Today, January 31, 2022, within the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw noteworthy options trading activity in Micron, which opened at $78.96.

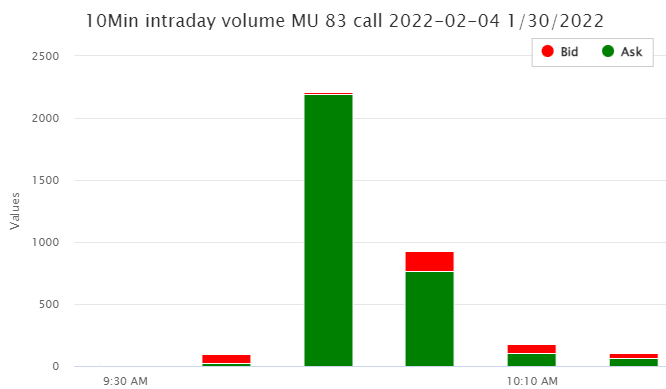

- 1,222 contracts traded on the $83 strike call option, bought to open at the ask, dated for February 4th, 2022.

- These contracts were traded at a spot price of $0.64 with a bid-ask range of $0.63 to $0.64.

- The open interest on this chain was 1,058 as of today’s open, and the total volume as of this writing is approximately 3,576 contracts traded on the chain.

- It is worth noting that as the bid-ask range on this chain was only separated by a penny, it is entirely plausible that the trader entered sell-side orders at the ask. As always, the holistic flow must be reviewed to understand sentiment.

These orders come just after The Motley Fool labeled Micron as one of its “3 Value Tech Stocks to Buy After the Market Sell-off”.

All orders thus far this morning have been ask-side orders, with the unusual volume reported here overtaking the chart completely.

Today’s volume has now overtaken open interest, so we can be rest assured that these orders were in fact to open, not to close; however, it cannot be known whether these orders will closed before the end of the day or not, and open interest as of tomorrow’s open will have to be reviewed to know if these traders remained in these positions or not.

To view more information about MU's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in PagSeguro Digital Ltd. (PAGS)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in PagSeguro Digital Ltd. (PAGS), which opened today at $20.57.

- There were 8,240 contracts swept at or close to the bid on the $17.5 strike put options dated for February 18th, 2022.

These orders come after Simply Wall St reported that PagSeguro’s “Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?”

Of interest, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible.

As seen, no other chains have had any significant volume, but almost all volume remains in puts; the sweeps on the $17.50 strike puts remain the most active thus far.

To view more information about PAGS's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Bed Bath & Beyond Inc. (BBBY)

Finally, and again in the NasdaqGS, we saw noteworthy options trading activity in Bed Bath & Beyond Inc. (BBBY), which opened today at $15.30.

These orders came in one after the other on the $10 strike put option dated for February 18th, 2022 with a bid-ask range of $0.05 to $0.07:

- There 9,788 contracts traded at the bid at a spot price of $0.05.

- There were another 9,789 contracts traded at the ask at a spot price of $0.06.

- As can be seen, this is the same predicament as in the previous unusual activities above, in that these chains have a tight bid-ask spread, and it is not entirely possible to know whether these orders were in fact bought or sold.

- However, we can know they were indeed opened, at least, as their sizes were greater than the chain’s open interest.

Additionally, these orders come after Eric Volkmann from The Motley Fool reported “Why Bed Bath & Beyond Stock Dived by 9% Today”.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Be mindful! Trades without the briefcase emoji might still have been bought or sold to open! You may also watch this video to see how to track these kinds of opportunities in the Unusual Whales flow.

Furthermore, just because these orders were indeed opened, it cannot be absolutely known whether these calls were sold to open or bought to open.

As of this writing, Bed Bath & Beyond has had 15,790 calls traded, down from 73,957 overall Friday, the 28th, but open interest has increased from Friday, implying more contracts remain open into today.

To view more information about BBBY's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.